Hot IPOs and the Wisdom of Groucho Marx

The ongoing mania for “unicorns” (private companies valued at over $1 billion) has is developing into a wave of very-high-profile Initial Public Offerings (“IPOs”). For example, earlier this year Snap Inc. (the parent of the popular Snapchat app – ticker “SNAP”) came to market with a breathtaking valuation. Investors have clamored to gain access to some of these high-profile IPOs, and we expect this pattern to repeat. Given that SNAP is now trading well below its IPO price, we want to share our perspective on the high-profile IPO phenomenon and what it means for our clients.

Of course, the best time to buy a successful IPO is well before the IPO. Unfortunately, this opportunity is generally restricted to venture capital firms, experienced angel investors, and close friends and family of management. The rest of us have to wait until the IPO. There is an exception to this rule, which is recently-established (and arguably largely untested) secondary markets for private shares, such as SecondMarket (which was acquired by NASDAQ). We don’t use, trust, or recommend such secondary markets for private shares. Perhaps with time they will become more dependable.

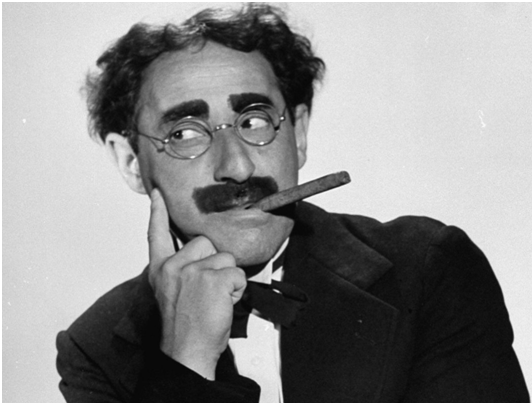

So the earliest shot we get is at the actual IPO. In this case, we heed the great wisdom of Groucho Marx (pictured above), who is famously credited with saying “I refuse to join any club that would have me as a member”.

Here’s why. Every investor wants to own the big name tech companies when they go public. But the underwriters (investment banks) get to allocate the shares as they please, and they use that opportunity to distribute them as favors to their most valuable clients. These are generally big hedge funds and huge mutual funds that generate the most trading commission dollars for the underwriters (who also end up being the broker/dealers in the secondary market after the IPO). Customers who don’t generate big trading commission dollars for the major underwriters (i.e. any investor that isn’t a big institution) don’t get allocations.

As a result, the only way you or any other individual investor is likely to get an allocation is if it’s a bad deal. Facebook provides the textbook example. Facebook’s IPO shares were widely distributed including to retail (non-institutional) customers. This is because every Facebook user and their friends wanted to own the stock and because the underwriters realized that to hit their price target they wouldn’t be able to place all the stock with institutional investors. As a result, the stock was initially overpriced. The IPO price was $38. Three months later it traded at $18, and a lot of retail investors were licking their wounds after losing more than half their money. We may currently be witnessing a similar situation with SNAP.

The lesson is that with a very hot IPO, it’s very risky to be involved because if the deal is distributed widely such that you get to “join the club”, then it’s probably overpriced and you would be better off “refusing to join the club”, like Groucho. You’re likely to get a better deal in the secondary market in the months following the IPO.

Facebook stock purchased well below the IPO price ended up being an excellent investment. Will SNAP be the same? Only time will tell.