How to Protect Yourself Against Cyber Crime

According to TransUnion, one of the four major credit monitoring agencies, identity theft is the fastest growing crime in America. Just last year, 16.7 million US consumers were victims of identity theft, an increase of 8% from 2016, resulting in over $16.8 billion stolen. As individuals try to combat this growing threat, it is important to know the different ways in which cyber criminals are attempting to hack and exploit your personal information.

Some of the most common methods of cyber crime are:

- Email Account Takeover – An email is hacked by a cyber criminal who searches for correspondence containing confidential financial information about the victim’s financial institutions.

- Malware – Malicious software is used to disable computers, steal data or gain access to networks.

- Phishing – Cyber criminals pose as a trustworthy source (like a financial institution) in order to gain confidential information like Social Security numbers, usernames and passwords, or credit card numbers.

- Credential Replay – Once cyber criminals obtain usernames and passwords, they test these against multiple financial institutions looking for matches. If a match is found, they either attempt to fraudulently request money, or resell this information for a profit.

- Social Engineering – This involves the manipulation of individuals by cyber criminals in order to obtain their trust to gain sensitive information from them.

- Call Forwarding – A cyber criminal arranges either through a stolen phone or through the phone company to direct all incoming calls to the criminal’s phone.

- Spoofing – A cyber criminal creates an email address or falsifies a phone number in order to mimic that of the victim to convince an institution to send money to the criminal.

WESCAP Group and our custodians use security procedures to try to prevent cyber crime , including password protection of files, a secure file sharing website, and other internal security measures to ensure your information remains safe. There are several measures our clients can take to ensure they do not fall victim to one of the above cyber crimes.

- Be Diligent – Carefully check incoming emails for the proper email address and accuracy of spelling.

- Antivirus Software – Install strong antivirus software on your computer.

- Password Policies – Always be sure to use a strong password, containing at least 8-12 characters and a mix of lowercase and uppercase letters, symbols and numbers. Additionally, do not use one password for all accounts.

- Additional Authentication – Consider additional authentication methods – either a secret password or security question or a verbal confirmation can help insulate individuals from identity theft.

- Utilize two factor authentication (2FA) either by receiving an additional phone call or text message, or an encrypted fob key furnished by your financial institution.

- Freeze Your Credit – Please click the following link to learn more about the ways in which you can freeze your credit.

https://www.wescapgroup.com/2017/10/24/how-to-freeze-your-credit/

Case Study: Phishing

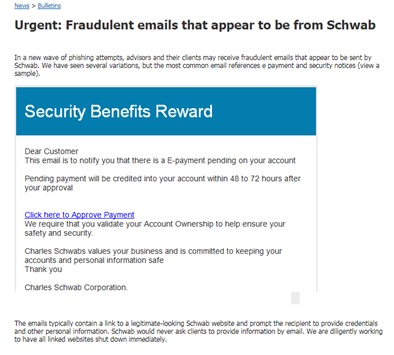

Recently, Charles Schwab & Co. released an urgent notice alerting WESCAP Group of a phishing attempt by a cyber criminal. Below, you can see the body of the email that several of Schwab’s clients received.

This illustrates a classic phishing attempt made by a cyber criminal fraudulently posing as a trustworthy source in order to obtain account ownership information. This information would then be used to attempt to access the account and move money without the account owner’s knowledge.

The regularity and sophistication of cyber crime continues to grow at a rapid pace and this is not exhaustive. While continued education and understanding of possible threats will help to prevent future breaches, we urge you to always act with care and caution in regard to your cyber security.

Please contact your WESCAP advisor with any questions or concerns.

WESCAP Group