Housing Market Update

In an effort to control inflation, the Federal Reserve continues to tighten monetary policy by increasing interest rates. Higher interest rates increase the cost of mortgages, which, in turn, decrease demand. Over the past two years, long-term mortgage interest rates have risen by 1.17%, raising the average monthly payment by 15.1% for the same principal balance, as shown below.

| Interest Rate | Term | Principal | Monthly payment | % increase in mo. pmt | ||

| Sept. 2016 | 3.46% | * | 30 years | $400,000 | $1,787.25 | NA |

| Sept. 2018 | 4.63% | * | 30 years | $400,000 | $2,057.76 | 15.1% |

* http://www.freddiemac.com/pmms/pmms30.html

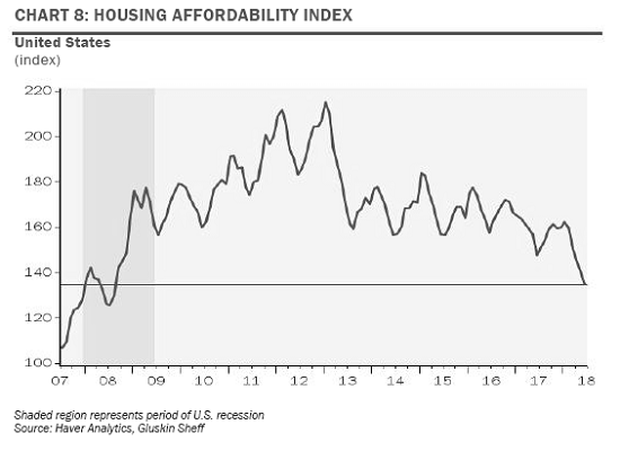

One of the biggest issues with the housing market is affordability. The chart below displays the downward trending index indicating that the affordability of homes is approaching levels not seen since 2008. With home prices reaching new highs in most areas, sales of homes are beginning to slow. In addition to high home prices and rising interest rates, the incentives to buy a home have been reduced due to the recent tax law change, which limits property tax deductions.

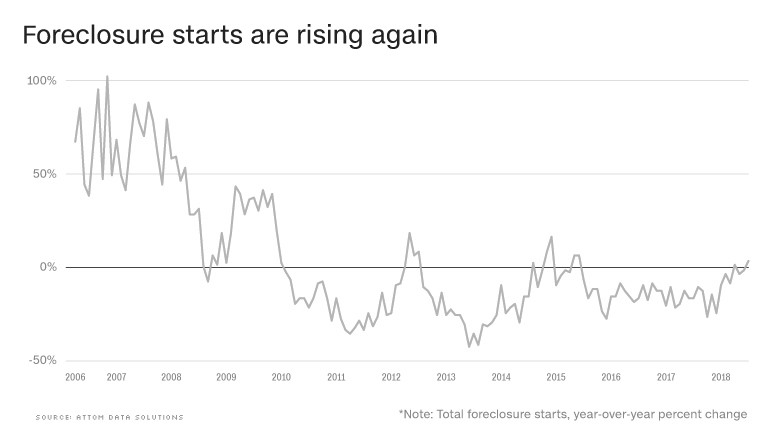

With decreasing demand, lenders may be forced to look toward higher-risk borrowers in order to maintain sales. As a result, those riskier borrowers could result in higher default rates on mortgages, as illustrated by the chart below.

With home prices hitting new highs, and a rising rate environment coupled with increasingly hawkish rhetoric from the Federal Reserve, the housing market may be near its peak for this cycle. Additionally, home builders are beginning to offer various incentives to offset slowing sales. This suggests that there should be no rush to buy residential real estate. Home builders, mortgage companies, construction materials and service providers should be underweighted in portfolios. A small reduction in domestic economic and employment growth should also be expected.

Please contact any advisor at WESCAP Group for additional details.

https://www.cbsnews.com/news/3-reasons-to-worry-about-the-housing-market/

https://money.cnn.com/2018/08/28/news/economy/housing-market/index.html