WESCAP Group Update on U.S. Recession Risk

Recent headlines regarding the yield curve inversion* have heightened fears of an impending recession. We discussed this topic at length in our January 2019 Outlook and we are reiterating our position that a recession is not imminent.

An inverted yield curve has often preceded a recession in 6 to 24 months, but it has failed to indicate a recession several times, especially when the absolute level of interest rates is low. We have never had an inversion with yields as low as they are now. Recessions often occur when interest rates get too high, which then triggers a decline in demand for highly cyclical products and industries (e.g. housing, cars, new plant and equipment), resulting in a business and employment downturn and inducing a recession. With both long- and short-term Treasury interest rates being below the inflation rate, monetary policy is on the accommodative side rather than being economically restrictive. Therefore, high interest rates do not appear to be a possible cause of recession, notwithstanding any inverted yield curve.

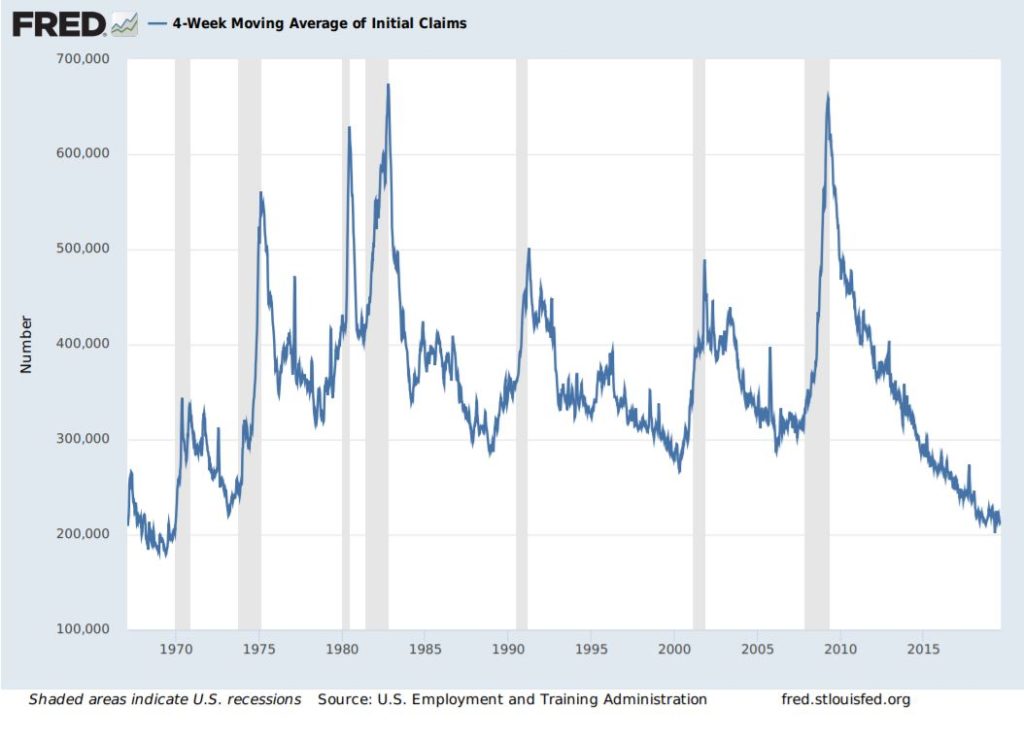

Additionally, there are other indicators that do not indicate a U.S. recession in the next 12-24 months. U.S. households make up about 70% of the economy and if they are doing well, a recession is extremely unlikely. A rise in initial unemployment claims has always preceded any recent recessions as shown on the graph below (recessions in grey bars). Note that we have not seen a rise in unemployment claims yet.

*Longer term U.S. Treasury yields being lower than on shorter term Treasury Securities

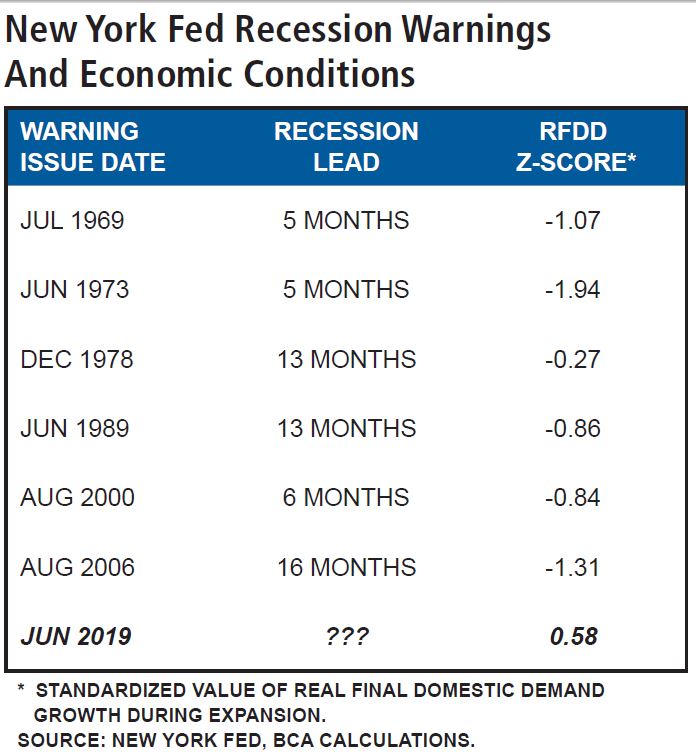

The New York Federal Reserve issued a recession warning in June based upon the recent yield curve inversion. Looking back at prior warnings (table above), consumer spending had already deteriorated to below average levels (RFDD Z-score below zero, BCA Research—US Investment Strategy June 24, 2019). However, this time around, consumer spending is above the current expansion average, thus suggesting that recession risk is not imminent.

Presidential election years and the year prior to elections tend to be good for stock markets. An incumbent president seeking re-election can pull various economic “levers” to stimulate the economy and thus improve chances of re-election. Lowering interest rates is one such stimulative lever. Current trade risks have resulted in the Federal Reserve reducing interest rates (with more reductions possible) and if trade policy improves marginally in the next 9 months, this would provide a combination of powerful economic stimulus levers prior to the election.

While we have good reason to believe that a recession is not imminent, we have to acknowledge that the risk is present. It is possible that too much talk of recession will result in both businesses and consumers getting conservative on spending plans, and thus a self-fulfilling prophecy recession could ensue in 12 to 24 months. There is a lack of evidence to support this case now, but it does not mean that it could not happen. Plus, unexpected events and things unknown now could prove our assessment wrong. Recessions are notoriously difficult to predict a year or more in advance.

Our current approach is to stay vigilant and monitor a variety of indicators. We do not want to overreact to current headlines and few inconclusive warning signals. We are willing to change strategy and shift to more conservative investments if warranted in the future by either economic or investment conditions. Nevertheless, this is a good time to review your risk tolerance and decide if you have a sufficient buffer to persevere through potential adverse investment performance for a period of time. While downturns are not pleasant, they can be tolerated if not forced to sell “risk assets” during this time period and can actually be quite profitable if risk assets are purchased near market lows.