WESCAP Update 3/17/2020: Current Coronavirus Outbreak

We stated in an earlier update that “it looks less likely than before that COVID-19 can be contained before it spreads to much of the world.” There was an opportunity even then for governments to take actions to mitigate its spread. Those opportunities were squandered. Two weeks later, the virus has spread to much of the world and is now considered a pandemic.

Belatedly, many national and local governments have begun lock-downs and quarantines to slow the spread of the disease. Public and sporting events have been cancelled. Individuals in most stricken areas are beginning to limit their interactions with other people (social distancing). Business and vacation travel have taken a sharp downturn. Meanwhile, domestic airports are clogged as people try to get home to hunker down.

At this stage, actions to contain the spread may or may not be sufficient to keep the pandemic from reaching most of the population. Either way, a recession in the U.S. and many other nations is now almost a foregone conclusion.

After lowering short-term interest rates two weeks ago to help counter some of the financial stresses of the downturn in global demand, the U.S Federal Reserve (Fed) offered $1.5 trillion of new money to support the repo market on Thursday, and then another $0.5 trillion on Sunday, as well as announcing $0.7 trillion of quantitative easing (printing money to buy bonds) and a further cut of short-term interest rates to zero. This amounts to a total rate cut of 1.25% and $2.7 trillion of total monetary stimulus. Moreover, the Fed announced that it would no longer require that banks keep any reserves on deposit at the Fed. This quantity of monetary stimulus is unprecedented, but we expect to see more, in conjunction with fiscal stimulus.

Significant fiscal stimulus (e.g. tax cuts, payments to people while quarantined, support of strategic industries, or other measures far in excess of what has already been announced) is all but guaranteed. The modest items that have been announced are likely to be followed by much larger programs. While Congress is technically endowed with the “power of the purse”, it is quite possible that the Executive Branch will order the Treasury to start writing very large checks to people and companies in order to keep the economy afloat.

Monetary and fiscal stimulus will not be enough to get people back on planes, visiting restaurants, going on cruises and going to large public events. The cure for sinking demand is to reverse the viral outbreak. This may take months. However, additional stimulus is likely to put a prop under financial markets.

Problems with having enough testing kits are being overcome. Without adequate testing, it is hard to know who to quarantine and who not to quarantine and who might be infected, but not showing symptoms. Until the last few days, testing in the U.S. was only done by public health agencies, creating a testing bottleneck. However, in the last few days, the two largest independent testing labs, LabCorp and Quest Diagnostic, announced that they can now test for the virus. Roche has announced a new test kit that can be produced 10 times faster. Also, biohacker teams from universities such as MIT are working on cheap testing systems. COVID-19 is fearsome, but so is human ingenuity. As testing grows exponentially, the ability to successfully test and quarantine those that warrant it should increase the prospects of slowing the transmission of the virus.

Slowing the spread of the virus is not a cure, but if the spread is sufficiently limited, then the virus has fewer people to infect, which reverses the exponential growth of new infections and allows the virus to subside on its own. Most coronaviruses subside this way and a few (SARS, MERS) have failed to come back once the viral spread stopped.

We expect increased global governmental efforts to slow if not contain the virus by supplying more test kits, more protective wear and training for health workers, and other increased resources to find and contain the virus and financially recompense those in quarantine or in financial distress.

Economic Expectations for 2020

The COVID-19 pandemic has severely reduced travel demand and is also adversely affecting lodging, and large public and corporate events. Many schools are closing campuses. In localities with COVID-19 expansion, restaurants and retail stores are seeing a large drop-off in business. Some countries have mandated closure of non-essential retail (shops, movie theaters). Apple announced the temporary closure of all its retail stores, except in China. All non-essential retail is likely to grind to a halt this week.

Loss of revenue and follow-up loss of wages and business closures and increasing debt defaults suggest that the second quarter of 2020 will show a sharp drop off in economic activity—likely large enough to cause a sharp contraction in economic activity in many countries, including most of Europe and the U.S. Increased monetary and fiscal stimulus, possible debt payment assistance and other targeted and broad measures are likely to be considered and implemented as a way to tide over the most financially distressed and provide a bridge to economic recovery later this year.

If COVID-19 reaches a peak and begins to recede in the next 2 months—likely given prior coronavirus experience—then economic activity should expand again in the third quarter. However, if COVID-19 does not act like prior similar viral outbreaks, then economic activity could decline for the next 2 to 3 quarters, ushering in the first official recession since the financial crisis. Natural epidemic tapering combined with containment efforts, better treatments, antiviral drugs and eventually a vaccine should result in the termination of the COVID-19 pandemic, but the time frame for this is still uncertain.

Investment Markets

Major stock markets have fallen roughly 30% from their recent peaks. Travel-related stocks have fallen by 50% or more. Even stock sectors that should be largely insulated from this demand shock have shown large declines (e.g. healthcare). Yesterday the volatility index (VIX) reached 80, showing panic-level volatility in U.S. stocks not seen since late 2008.

The U.S. was ground zero for the excesses that precipitated the financial crisis. This time, China was ground zero for COVID-19. New cases in China appear to have tapered off, though we must always take Chinese data with a large grain of salt. The data suggests that strong containment measures can work. Last Thursday, there were 8 new cases in Wuhan, the first time since January that new daily cases were not in double digits. This daily decrease in new cases has been going on for several weeks, prompting Chinese authorities to allow limited travel in the Hubei province and allowing some Wuhan businesses to reopen. Within 3 months, the outbreak has gone from high exponential growth to apparent decline. Hopefully, this time frame of growth and decline can hold true for other severely afflicted regions that adopt strict contagion measures. Chinese stocks are holding up better than U.S. and European stocks in the last week, likely reflecting the improvement in China and escalation of new cases elsewhere.

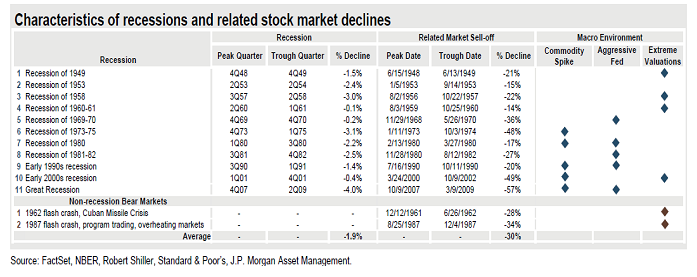

U.S. stock prices are already reflecting the likelihood of recession. Since 1949, we have had 11 recessions. The average S&P 500 decline for the recessions and two non-recession bear markets was 30% (last row, next table). Most of the recessions had stock market losses of under 30%. The last two (dot.com and financial crisis) were worse, but a coronavirus-driven lost-demand recession is unlikely to be as severe to the economy and markets as the housing bubble, debt meltdown of the financial crisis or the extreme optimism/valuations of the dotcom bubble.

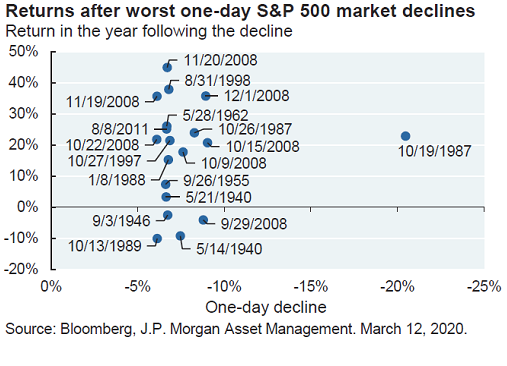

While it is possible that stock prices could sink further in the coming weeks it is difficult to account for investor fears, leverage, and algorithmic computer trading in the short-run—we would find it surprising not to see prices trending higher starting within the next 1 to 4 months. Yesterday’s stock market decline of roughly 12% ranks as the worst since 1987. However, historical evidence shows that in 15 out of 19 of the largest single-day declines, stock prices were higher one year later, as shown in the following graph.

Until the earnings picture becomes clearer in a few months, it might be prudent to avoid travel and lodging stocks, commodity sectors, and those most impacted by the demand shock now unfolding. Healthcare stocks and steady growers whose stock prices have also declined should benefit from a rebound with less risk from fundamentals deterioration.

High yield debt and bank loans have also been hit hard. Avoiding oil sector debt is recommended as U.S. bankruptcies in this sector will likely be on the rise. Bank loan debt has less oil sector exposure and is higher in the corporate credit hierarchy.

Financial markets are extremely stressed. But despite the economic mayhem ahead of us, we are not sellers of risk in the face of the Federal Reserve printing $2.7 trillion and likely enormous fiscal stimulus. Someday the world’s governments may run out of ammo. We are not there yet.

Please contact WESCAP to discuss in more detail.