WESCAP’s Mid-April Take on the Coronavirus Outbreak and Investment Implications

Summary: Covid-19 appears to be retreating. Many countries can begin to reopen large parts of their economies in the next month or two. Much of the economic damage is still unknown, but it could be worse than expected, though it may reverse fairly quickly. There is a good chance that stock prices saw their lows in late March, but some additional price risk may reappear as economic fears reach a maximum over the next few months.

Virus spread retreating and implications for the economy, stocks and other assets

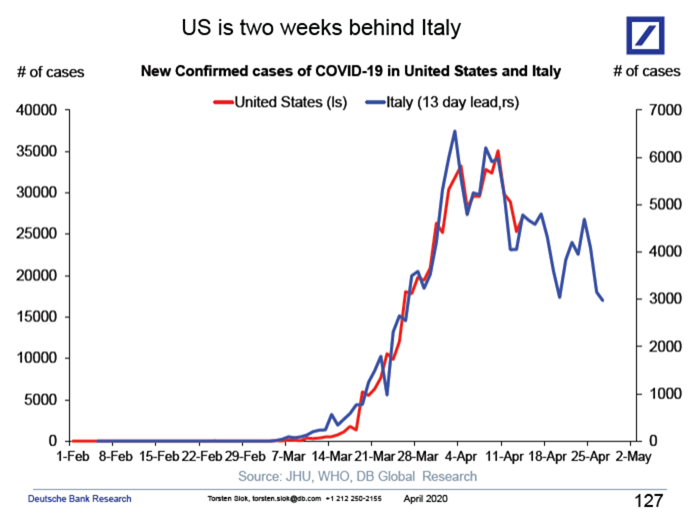

Actions taken by global governments coupled with people following social distancing practices have been successful in slowing the spread of Covid-19. Most of China is getting back to work, which sets the time frame at a few months for the rest of the world. New daily cases are dipping in the U.S., Italy and most other areas. If you take 13 days off the Italian data, the shape of the new infections graph looks nearly identical to that of the U.S. as the graph below shows. If the U.S. follows Italy’s improvement, this means the worst is over. Data and graphs on each country can be found at https://www.worldometers.info/coronavirus/.

In our first report on Covid-19 on February 27, we stated that “it looks less likely than before that Covid-19 can be contained before it spreads to much of the world.” This turned out to be true. In our March 17 follow-up we said “Increased monetary and fiscal stimulus, possible debt payment assistance and other targeted and broad measures are likely to be considered and implemented as a way to tide over the most financially distressed and provide a bridge to economic recovery later this year.” Shortly thereafter the CARES Act was passed and the Federal Reserve took additional dramatic actions. Most major foreign governments took similar actions. We also noted in this April report regarding stock markets that “we would find it surprising not to see prices trending higher starting within the next 1 to 4 months.” On March 23, six days later, the U.S. stock market hit a bottom.

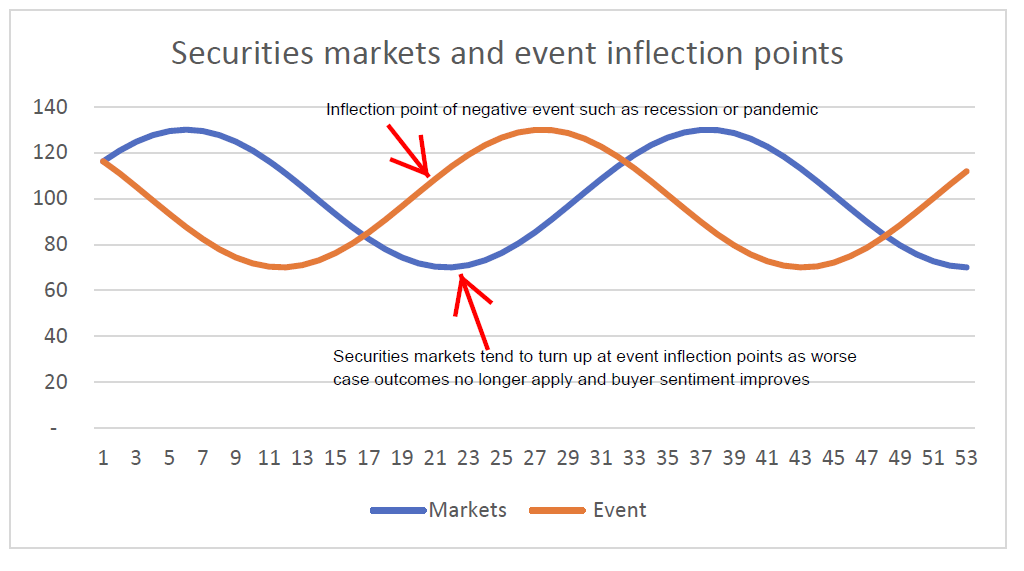

Stock markets tend to respond well in advance of bottoms of recessions, hence why they are considered a leading economic indicator. Stock markets tend to turn up at inflection points, when things are still getting worse, but there is an improvement in the rate of change of the worsening event.

In the general example chart above, the orange line inflection point is indicated by the arrow about halfway up the slope of the orange line. This is where the concave shape turns to convex. Acceleration turns to deceleration. If this orange line represents the total population actively infected with the Coronavirus, this inflection point is when the new daily cases begin to decline. It may take more time before the peak in infected cases occurs (the peak of the orange line), but for stock and credit markets it is the inflection point that matters most. This is when the light at the end of tunnel is seen and when worst-case scenarios are discarded. Pessimism begins to slowly recede and sentiment improves and risk assets, like stocks and credit-sensitive bonds, also begin to rise, as represented by the arrow in the blue line.

While the worst of the pandemic could be behind us, the worst of the economic consequences of the pandemic are still in front of us. U.S. unemployment could rise to 20%+ in the U.S. for a short time and personal and corporate bankruptcies are likely to rise despite various government assistance programs. The ratings agency, Fitch, recently forecast a 15% cumulative default rate for 2020-2021 for the lower credit quality high yield and bank loan markets. As the economic numbers come in, they could be quite a shock to most people.

Therefore, we are not likely at the inflection point now for defaults, unemployment and the economy in general. As people begin to fear the worst for the economy, we could easily see at least one more major pull back in stock and risk asset prices in the U.S., Europe and Japan, to name a few regions. We may not see the March 23 price bottom again as that was not only driven by fear and uncertainty, but also by a looming credit crunch and a lack of liquidity that was successfully addressed by actions taken and maintained by the Federal Reserve and by the U.S. Treasury. But even if the bottom of the markets occurred in March, it does not mean an end to additional large price swings in the coming months.

Sometime in the next few months we could see inflection points in both the rates of unemployment and the rate of GDP contraction, still worsening, but at lower rates. These inflection points then could lead to a more sustained recovery in tradeable risk assets (stocks and bonds) and non-tradeable assets such as real estate. Certain assets and activities may be impaired until a vaccine is widely available in 2021. Hotels, malls, travel, restaurants, and large events may suffer low activity well into 2021, thus slowing the economic recovery after a large initial economic post-pandemic bounce. This could mean the first 2/3 of the economic recovery could happen very fast, while the last 1/3 could drag out for several years.

While we cannot say when we might have a 15% to 20%+ drop in stock prices again, if it does happen, it will likely be over the next few months. Therefore, for risk tolerant investors, buying high quality, fundamentally strong business assets during 15% or greater price dips over the next few months should show good results within 6 to 18 months. For less risk tolerant investors, own significant amounts of high-quality bonds, perhaps a little gold and do not panic and sell assets near their pricing lows. If overweight in stocks right now after the post March 23 strong price recovery, now would be a good time to trim these positions a bit.

This all presumes that Covid-19 does not mutate and comes back even stronger in the fall, and that the health-related current government induced shut-downs are not reversed too quickly causing a major Covid-19 rebound. There is still a lot we do not know and cannot know about this virus and its future. Nevertheless, we have outlined what we believe is the most likely scenario, given the imperfect information we have available.

Please contact us to discuss this further and what actions, if any, are warranted for you.