Economic and Investment Outlook for 2021

This year we wish to focus on the main questions investors are asking coming into 2021: Will the Coronavirus be conquered? What does this mean for people, businesses and investors?

2021 Outlook Summary

- Coronavirus Pandemic: Recent vaccines appear to be highly effective, generally safe and long-lasting. Public resistance to being vaccinated is waning. Vaccine production and distribution is expected to improve. Therefore, the most vulnerable portions of the population should be vaccinated by spring or early summer, and the pandemic should be less infectious. Nevertheless, virus mutations do provide an ongoing risk to our base case scenario.

- Economic Growth: Real GDP growth should bounce back from the 2020 recession. High levels of continuing monetary and fiscal stimulus around the world should benefit consumers, workers and corporate earnings. Growing levels of government debt may present a problem long-term, but not until both inflation and interest rates significantly rise, which may be years away, if ever.

- U.S. Equities: An 18% increase in the S&P 500 in 2020 resulted in most stocks moving from slightly overvalued to significantly overvalued, although low interest rates and other forms of economic stimulus could support these valuations for a longer than typical period. This translates to modestly positive returns in 2021 expected for stocks, though near-term risks remain elevated.

- Foreign Markets: Economic conditions in many larger foreign developed and emerging market countries are expected to improve as well. Valuations in non-U.S. stock markets are more attractive than in the U.S. There is a reasonable chance of a stable or declining dollar, which would also favor owning more non-currency-hedged foreign stocks and bonds. Therefore, we continue to have a substantial allocation to these markets.

- Fixed Income: U.S. and most developed country interest rates are expected to remain at multigenerational lows as a stimulus response to the pandemic. This makes most high-quality fixed income investments unattractive, except as a risk buffer for those who need it. However, some credit-sensitive fixed income continue to offer above-inflation yields.

- Alternative investments: Given a lack of yield in many fixed income assets and potentially lower returns from U.S. stocks, additional consideration should be given to non-traditional assets. These could include hedged strategies, private investments and commodities, including precious metals. Mutual funds, ETFs and hedge funds are all avenues of investing in these assets and strategies.

SARS CoV-2 (COVID-19) Outlook

The SARS-CoV-2 virus is one of a longline of coronaviruses (common cold, SARS, MERS) that in this most recent manifestation had just the right attributes to have sparked a deadly global pandemic. A high transmission rate, infectiousness before symptoms appear (if at all) – deadly consequences for some and no symptoms for others – conditions that were ideal for the virus spreading across the globe in 2020. In addition to the human tragedy created, it devastated many business sectors and triggered a global recession. The trajectory and fate of the virus is intertwined with global economic and investment prospects and, therefore, this virus is the starting point for this report.

In late February 2020, in our first report on this topic, after half of the infected persons on the Diamond Princess cruise ship showed no symptoms, we wrote “Lack of symptoms while being infected and being able to infect others will make virus containment difficult.”

Recently, the U.S. Center for Disease Control (CDC) estimated that 25% of the country has already been infected, which is more than 3 times higher than reported, mostly due to asymptomatic cases and mild cases that were never reported. This would put the actual fatality rate not at 1.7% to 2.0% but closer to 0.5%-0.7% of all COVID-19 cases. A shift to younger people getting infected and better treatment protocols have also lowered both the reported and true fatality rates. Nevertheless, this is still a disease that can kill, especially for older people or those with underlying health conditions. Furthermore, if hospitals get overwhelmed, which is still a real possibility, then fatality rates could spike due to inadequate treatment.

The new “UK” Coronavirus variant B.1.1.7 appears to be 30-50% more contagious per a recent UK study. The CDC predicts this variant will become dominant in the U.S. in about 2 months due to the higher rate of contagion. This could cause another surge in infections in the coming months. This may also increase the herd immunity threshold from approximately 70% to closer to 80%. Fortunately, this variant does not appear to have a higher fatality rate and is close enough to older variants for current vaccines to work effectively. Nevertheless, there is a real possibility of another surge that may be hard to cope with unless vaccination rates are greatly accelerated.

The two most effective vaccines thus far are the messenger RNA vaccines from Pfizer and Moderna. They are the ones being used primarily in the U.S., Canada, much of Europe and parts of Asia. Not only are they 95% effective with two doses, but they have few side effects for most and are easier to ramp up production compared to traditional vaccines. Even for the 5% that were not completely protected from infection, the symptoms were less serious. As vaccinations ramp up, it is possible the U.S. could reach herd immunity by this summer, thus effectively ending the epidemic in the U.S.

For those previously infected, evidence points to close to 95% being protected from being symptomatically reinfected (The Scientist, Jan. 14). And for the few who do get infected again, 70% have no apparent symptoms. This nearly 95% immunity rate is up there with the two vaccines mentioned.

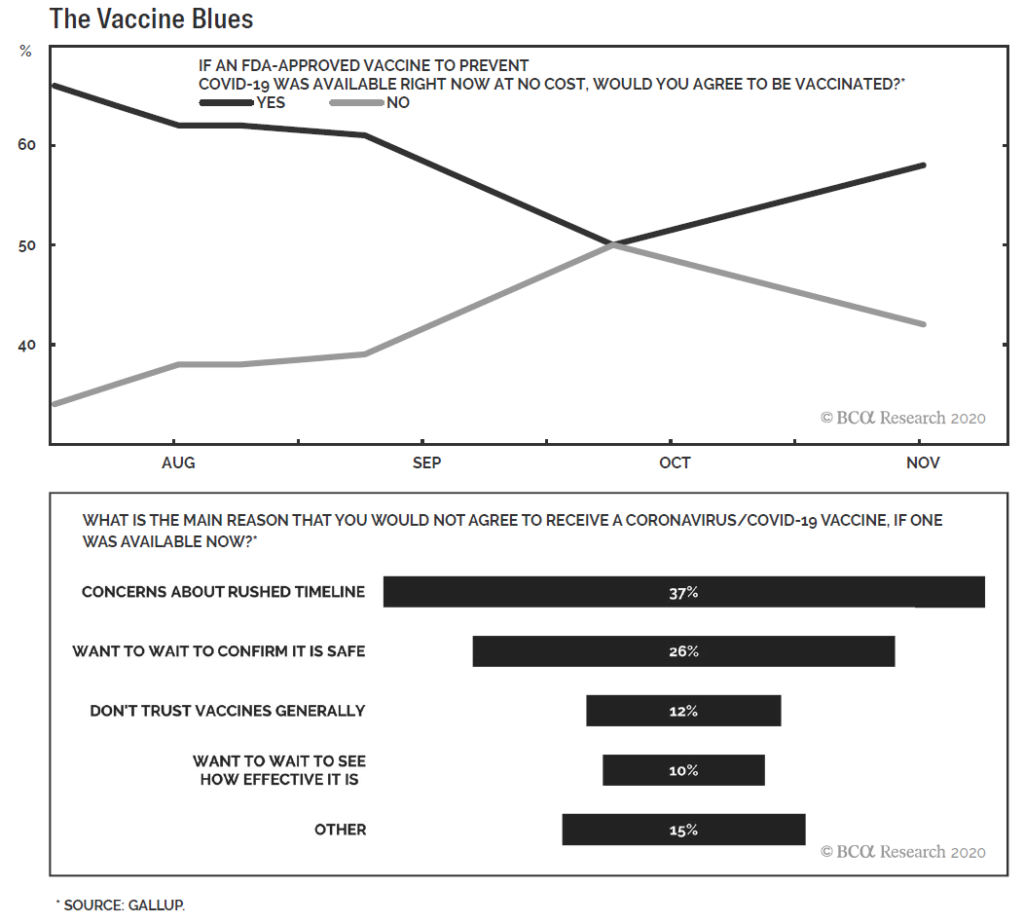

This is important because not everyone is ready to get vaccinated. In the U.S. only 58% were ready to get vaccinated in late October as shown in the following chart. Of the 42% who were not ready to get vaccinated, nearly 73% had concerns about a rushed timeline, or wanted to wait until it was proven safe or proven effective. The other 27% had more long-term reservations about vaccines. The two new vaccines approved in the U.S. have shown to be highly effective, with a low percentage of those vaccinated showing other than mild side effects. As a result, some of those who wanted to wait to get vaccinated no longer want to wait. A December Gallup poll showed that 63% of the population was ready to get vaccinated. Other more recent polls point to an over 70% approval rate to being vaccinated. However, it might be difficult to get over 75% of the population vaccinated, as about 25% of the population either don’t trust vaccines or have other reasons, such as thinking they don’t need them (e.g., low risk younger people).

BCA Outlook 2021

However, recall earlier that up to 25% of the population may have already been infected and thus also have 95% immunity. Therefore, of the 25% that may never get vaccinated, 25% of them or 6.25% in total are already highly protected. So, the total protected population should approach 77.2% (75% vaccinated plus 6.25% unvaccinated but previously infected people times 95% protection rate). This is close to the “herd immunity” level needed to stop the epidemic and keep it from coming back. Even more than 75% may get vaccinated if it is required to attend college, travel overseas or to have access to other activities.

There will likely be localized outbreaks going forward as vaccination rates are not expected to be uniform. Resistance to vaccination based upon political affiliation, ethnicity and age could result in certain areas having lower vaccination rates. Stronger outreach programs or other inducements may be needed to reach these groups more effectively to reach nationwide herd immunity and reduce periodic new outbreaks.

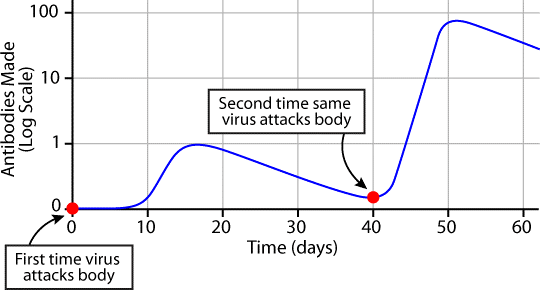

How long will this immunity last? For the current virus strains, immunity may last decades. While antibodies decline as the body doesn’t need them post-infection, long lasting memory B cells can ramp up antibody production much more quickly than previously, often so quickly that a reinfection is eliminated before it can cause damage, as illustrated in the following graph.

This graph shows how Memory Cells help you to better fight infections. At day 0, someone catches a virus. At day 10, her B-cells start making antibodies, and by day 15 she’s made enough antibodies to destroy all the viruses. Now, she doesn’t make any more antibodies, so fewer and fewer are left in her body. At day 40, the same virus gets in her body again. Since she has Memory B-cells prepared to fight, she can quickly make 100 times more antibodies than she did during the first infection. Source: https://askabiologist.asu.edu/memory-b-cell Date published: August 4, 2011

The median time between getting infected and showing symptoms of the coronavirus is just over five days. So, the sooner your body can respond (antibodies, T-Cells and other immune responses) the better, hence the importance of memory B cells when it comes to reinfection.

For example, memory B cells targeted against small pox remain at stable levels up to six decades after inoculation. Small pox is one of the largest, most stable viruses, and thus a 60-year-old vaccination is still effective. Influenza is one of the smallest viruses and subject to a large number of quick mutations, thus requiring frequent new vaccines. Coronaviruses are in between as to size and resistance to significant mutations. SARS was the first deadly coronavirus, and it appeared in 2002. It took ten years for the even-more-deadly MERS to appear and about eight years for COVID-19 to happen. So about once a decade a new coronavirus makes its way from the livestock/wildlife world into humanity. In wildlife and livestock, a number of viruses can recombine to form new ones, often being asymptomatic in non-humans and thus getting passed on to humans more easily. Reduction of live markets with wild animals, which has been partly implemented in China, and better livestock management practices, have the potential to slow down emergences of new and unpredictable viruses. COVID-19 has been a shocking wakeup call regarding pandemics, but it may lead to better preparedness for future epidemics.

Although new coronavirus strains are appearing almost weekly, most involve minor genetic changes that have little effect on the virus or the effectiveness of the vaccines currently developed. However, the more people that become infected, the more virus mutations occur—more people infected equals accelerated mutation possibilities. Over time some new virus variants could exhibit some important changes which could include some resistance to the current vaccines. The new South African B.1.351 strain appears to partly resist current antibody protection, though current vaccines are still expected to provide partial protection and reduce symptoms. Thus, it is a race now to bring down the number of people infected before newer virus mutations occur. If the pace of vaccinations does not keep pace with mutation acceleration, then a new surge of infections could arise worldwide and thus keep the pandemic going past this summer. We should know within the next several months if such new strains pose a real risk of prolonging the pandemic. If new viral strains do not pose a new risk by late spring, then cumulative vaccinations should begin to lower the risk posed by significant virus mutations.

Science has shown the ability to develop new coronavirus vaccines at astonishing speeds and it should be even faster in the future to tweak the current vaccines against new coronaviruses. However, if new vaccine trials are required, then it could take more than 6 months to see new vaccines arrive. The FDA and other regulatory bodies may have some tough decisions ahead.

As a result, our base case is that we expect the coronavirus pandemic to begin to wind down sometime in the spring and be largely over in developed countries sometime in the summer. However, we must acknowledge and plan for the possibility of worse outcomes.

Additional sources of all facts stated here are available upon request.

Economic Conditions and Outlook

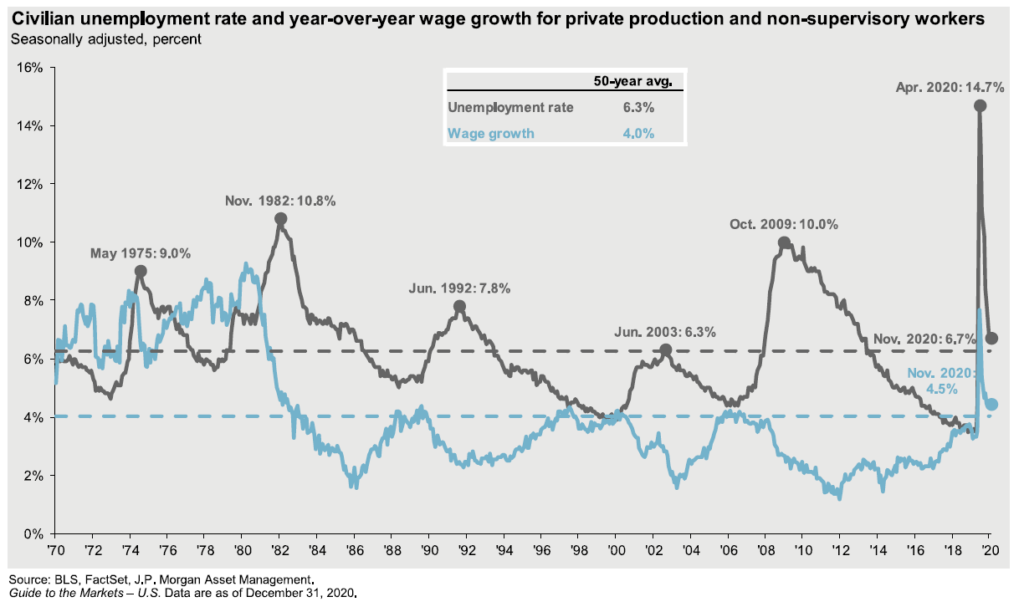

The 2020 coronavirus pandemic completely obliterated our early 2020 expectation of modest global economic growth and continued record low unemployment. Mandatory business and school shutdowns and avoidance of large gatherings (sporting/music events, congested airline seating and the like) caused a large drop in overall business and personal activities in 2020 and created a spike in unemployment, starting in March and continuing until May.

However, these conditions started to reverse as soon as the Federal Reserve began its massive stimulus and financial support measures combined with fiscal stimulus in terms of the CARES Act.

By summer, many service businesses were allowed to reopen. As can be seen in the next graph, U.S. unemployment reached a peak of 14.7% in April, only to fall back to 6.7% by year-end 2020, barely above the 50-year average unemployment rate of 6.3%.

However, in early January 2021 there has been an uptick in first-time claims in unemployment. The winter surge in new coronavirus cases has resulted in certain businesses (e.g., restaurants) and activities being curtailed once again. If the new UK virus variant becomes predominant in March, as many expect, another infection surge could occur, slowing economic recovery and resulting in unemployment rising modestly again. A double dip recession is thus possible, though the second dip would likely be mild.

Several reasons account for the rapid reduction in the unemployment rate in 2020. When government-mandated business and stay-at-home restrictions were loosened, many workers were able to pick up where they left off. Government PPP loans/grants assisted with this, as did direct support payments to many families. Many businesses also thrived in the COVID environment, including direct-to-home package and food deliveries, home improvement products and services, stay-at-home media services and home exercise equipment. Employment and business activity in these and related sectors helped offset some of the losses in other service sectors.

In 2021, post-COVID pent-up demand is expected to result in large global GDP increases relative to 2020. JP Morgan came out with their 2021 projections of GDP growth as follows: US—5.5%, Euro area—4.8%, China—9.2%, Emerging Markets—7.3%, and 5.8% worldwide. This is powerful growth, though a lot of this is just making up for the decline in 2020. However, this pent-up demand for services, travel and entertainment, along with a large bump in the money supply, could result in another long period of prosperity similar to the roaring 20s following the 1918 influenza pandemic.

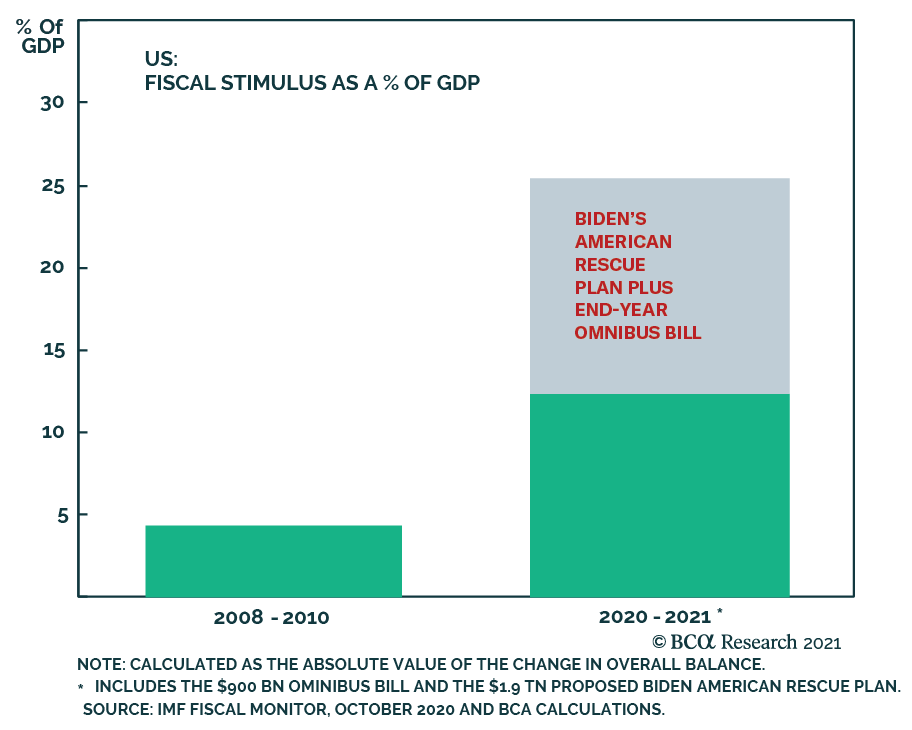

Continued QE stimulus from the Federal Reserve is expected to last at least through 2021, and low Fed Funds interest rates—barely above zero—are expected to continue into 2023. Combine this with somewhat similar stimulus programs from other countries and what is likely a $1.0-1.9 trillion stimulus package likely to be passed by the Biden administration in 2021 (see next chart) and we have all the ingredients needed for a long, strong new economic expansion.

.

If new strains of the coronavirus delay the end of the pandemic, then we can expect the stimulus to last longer and be strengthened. In this case, economic recovery will be delayed, but strong post-COVID growth should still occur.

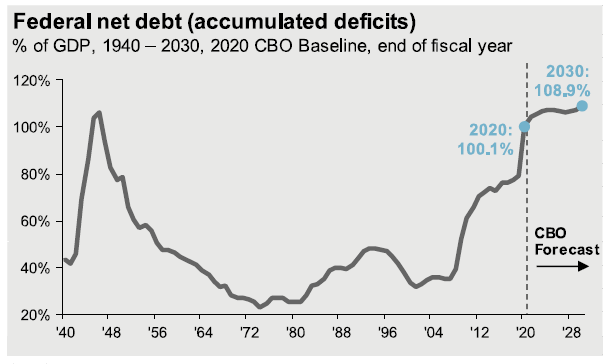

Of course, these various stimulus programs have a cost that will need to be paid via higher taxes or more government debt issuance. The following chart shows that the federal debt-to-GDP ratio has increased in the last year to a level not seen since World War II.

JP Morgan, CBO, US Treasury

Unlike the post WWII period, this high debt to GDP situation is not expected to decline, but rise a bit more. Slow GDP and working age population growth after 2021, increased Medicare and retirement benefits, and an expectation of only modest tax increases are consistent with stubbornly high federal debt forecasts.

Do such high debt levels really present a problem? In the short run—2-4 years, the answer is probably “no.” The cost to service the debt has taken a steep decline in the last year as T-bill interest rates are barely above zero and 10-year T-notes are barely at 1%. For example, when interest rates drop 50%, you can have twice as much debt without paying more in total annual interest, so for now there is no material additional financial stress created from this additional debt issuance.

A significant increase in inflation could lead to higher interest rates and this, in conjunction with a large debt load, could significantly slow the U.S. economy for decades to come. But inflation in 2020 of under 1.5% (CPI and other measures) is not high, and thus interest rates can be kept low. Considerable slack in the labor market is likely to keep inflation low for several more years as well. After a few post-COVID years, we could see some of these costs rise, and if productivity doesn’t keep pace, then inflation and interest rates could start an upward trajectory. However, even then, the Federal Reserve could take various actions to suppress a rise in interest rates. As the world’s reserve currency, the dollar and Treasury securities remain in high demand which would also limit any interest rate rise. There is a scenario in which rising inflation gets above 5% and causes the Federal Reserve to want higher interest rates to cool off the economy and reduce inflation pressures. We may be a long way from this occurring.

Higher federal taxes are not likely to materialize right away as that would slow growth and run counter to actions desired when trying to recover from a recession. However, in 2022 or 2023 we could likely see both higher federal corporate taxes and personal income taxes. While low-cost debt seems the easiest way to finance recent and forecast U.S. deficits, there is a desire by the Biden administration to shift some wealth from the well-off to those less well-off, thus reducing the wealth gap and social tensions. For at least the next two years, with 50 republican senators and a few democratic senators that are not likely to support large tax increases, we would expect only modest tax increases affecting large corporations and for those people making over $1 million a year. However, if there is a stronger-than-expected desire to reduce U.S. government debt financing, it is possible that we could also see some changes to federal capital gain and estate taxes.

While the current COVID-19 focus has rightly been on the health of the population and the economy, it has also had some positive benefits that could permanently benefit the economy and many people.

COVID-19 is transforming how people and businesses behave. Business travel and office space needs appear permanently reduced due to work-from-home practices becoming widespread and practical. In urban areas, the 1-to-3-hour daily commute can be replaced with higher productivity and less stressful work-at-home practices. Better yet for many, dense urban living can be replaced with suburban and more-rural, less-congested ways of life. Movement from dense high-cost locales to lower-cost locales no longer will come with a downgrade in career choices for many people. Improvements in quality of life plus higher productivity are likely to make many of these changes at least partly permanent.

Similarly, digitized information, AI, virtual meetings and appointments are transforming medical services, supply-chain management and many customer services. Many of these transformative trends were well under way, but a decade’s worth of changes may have occurred in one year.

A recent McKinsey study reported a counterintuitive fact–there were 1.5 million new business applications in the U.S. in the third quarter of 2020, nearly double that of the same period the previous year. New technologies and recognition of new opportunities are creating new businesses during this pandemic at an unexpectedly rapid pace. This is quite different than what happened following the 2008 financial crisis. While not all of these new businesses will survive and thrive, it is a very promising development that bodes well for the future. If many of these new businesses do pan out, then GDP growth and productivity may be higher than expected.

Note that for other foreign countries, the narrative is essentially the same. Between massive stimulus and successful vaccines, it is only a matter of when, not if, the pandemic ends, allowing the current robust economic and employment recovery to continue. Some countries are ahead, like China, and others behind, like Brazil. However, as the timing is the only real variable, not the outcome, we won’t get into details here.

Geopolitical tensions will continue to exist between the U.S. and China, the Middle East, Russia and elsewhere. However, the new U.S. administration is likely to follow a more collaborative approach to trade and other cross-border disagreements with Mexico, Canada and traditional European allies. Tariffs and trade impediments should also trend down, which will allow for costs to decrease and result in a better, more efficient, allocation of resources, goods and services around the world

Stock Market Fundamentals and Dynamics

In our January 2020 outlook from one year ago, we wrote “The coronavirus outbreak, while unfortunate, is not expected to have a long-term impact on most global stock valuations.” Despite most global stock markets falling 30% more in March 2020, by year-end 2020 most had turned a profit for 2020. So COVID-19 had only a fleeting negative effect on most stock prices.

Why such a “disconnect” between stock markets and the still negative effect on global economies and jobs? The answer lies in both the massive monetary and fiscal stimulus activities and that most large companies are doing well in spite of the coronavirus. Many small mom and pop businesses can’t survive long if forced to shut down, unlike large firms with larger cash reserves and better access to capital markets. Additionally, the liquidity injected by the Federal Reserve and other nations’ central banks boosted financial system liquidity, some of which flowed into stocks, thus supporting prices in these markets. The most severe business shutdowns were at least partially alleviated within a few months, allowing for business activity to pick up. Finally, the CARES Act fiscal stimulus in the U.S. and some similar programs overseas provided support to some key industries and put money into the hands of many households that allowed them to continue spending despite temporarily high unemployment rates.

These factors largely explain why stocks have done so well despite being in the midst of a pandemic. But have they done too well? Are we poised for potential disappointment and asset price declines going forward in 2021 or not too long afterward? The answer is both “yes” and “no.” This is possible because the stock market is actually composed of many individual stocks—it is a market of stocks rather than a single entity called “the market.” Many types of stocks and sectors are currently attractive, while others are not and this latter group could be poised for significant declines in 2021 or perhaps later.

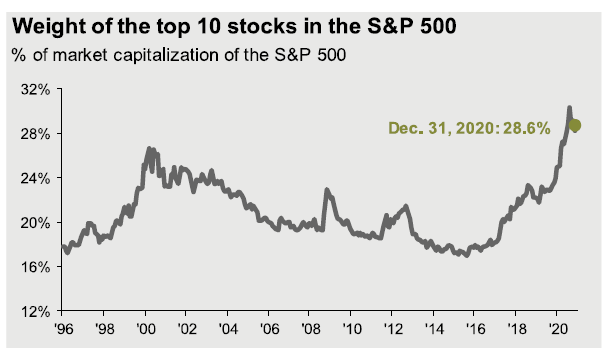

The S&P 500 is often considered the de facto definition of the U.S. stock market.

Factset, Standard and Poors, JP Morgan

However, the largest 10 stocks make up 28.6% of the index, which is a greater top 10 concentration than at the peak of the 2000 “tech bubble” (above graph).

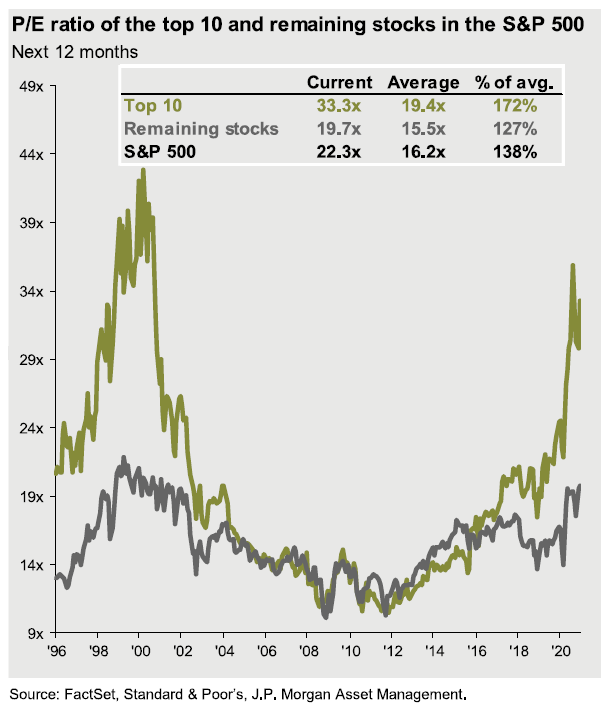

Being big is not by itself bad, notwithstanding growing anti-trust and regulation sentiment. However, these firms are also priced extravagantly. As shown in the next chart, the top 10 stocks have a price to earnings (P/E) ratio of 33.3 versus a much less expensive 19.7 for the other 490 stocks in the index. Valuations do matter, and expensive stocks tend to eventually disappoint as the extreme revenue and earnings growth required to justify such rich valuations eventually falter.

The unprecedented monetary and fiscal stimulus could very well be creating a number of asset bubbles as significant money has flowed into stocks and bonds, and investor sentiment has become increasingly bullish. The year-end AAII poll of individual investors resulted in a year-end bullish rating of 46.1 versus the long-term average of 38.5. Investors are feeling confident. However, this indicator has proven to be a reliable short-term (6 months) contrarian indicator, suggesting the possibility of weak or even negative returns over the next few months.

Signs of speculative froth include Special Purpose Acquisition Companies (SPACs) bringing $73 billion of private companies to the public in 2020 versus just $19 billion in 2019. This also exceeded 2020 traditional IPOs that came in at $67 billion. SPACs can buy firms with much less disclosure than required by IPOs, but investors/speculators are flocking to them anyway. Over-the-counter (penny stocks) trading topped 1.1 trillion shares in December 2020 versus 0.29 trillion shares in November and even less for prior months.

Our analysis on why many popular growth stocks are at risk of large declines or at least significant stock price underperformance can be found in our August 2020 “Tech Bubble Deja Vu?” report here: https://www.wescapgroup.com/2020/08/20/tech-bubble-deja-vu/. Note that since we wrote this report, smaller cap and value stocks have significantly outperformed growth stocks, just as we surmised. This change in stock market leadership may persist for many more years as we move into the post COVID phase.

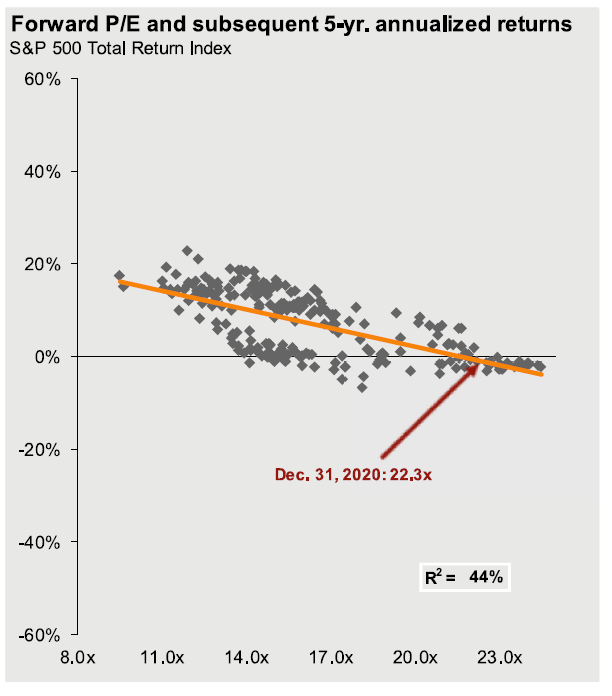

When the S&P 500 is as richly valued as now, past experience has shown slightly negative returns the subsequent 5 years, as shown in the next graph.

Extremely low interest rates and other current financial stimulus does support higher valuations, so total S&P 500 returns may be somewhat better than past experience has shown, at least until interest rates rise and stimulus decreases, starting in perhaps two years.

What should be done to avoid either underperformance or losses from the S&P 500 cap-weighted index and from the large mega-cap tech stocks? The answer is simple: reduce investment in S&P 500 and mega-cap and expensive growth stocks and own less expensive smaller cap and value stocks, including those overseas.

While tech and growth stocks have done well during the COVID-19 period, more economically sensitive stocks and sectors should outperform during the post COVID phase. Industrial firms, consumer cyclicals, financials and a number of COVID epicenter stocks (energy, airlines, restaurants, etc.) should outperform. Many already have moved up sharply since November 2020, but others have not, but could do so over the next 18 months.

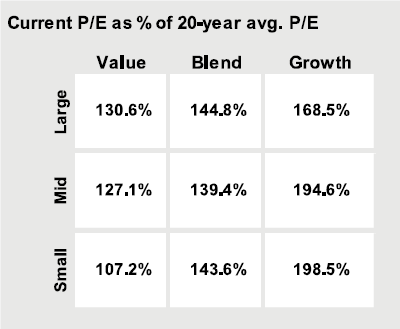

Valuations for value stocks and even “blend” stocks are much more attractive, as can be seen below.

Based upon valuation, the most attractive U.S. stock asset classes appear to be small-cap value followed by mid-cap and large-cap value, and “blend” for mid-cap stocks. Growth is expensive all around with small and mid-cap growth particularly expensive. We recommend overweighting the attractive valuation sectors and underweighting growth stocks and the S&P 500 index. We could see growth stocks surge higher again due to a recent coronavirus surge, but in the longer term we expect them to underperform, though there will always be individual stocks that buck the trend.

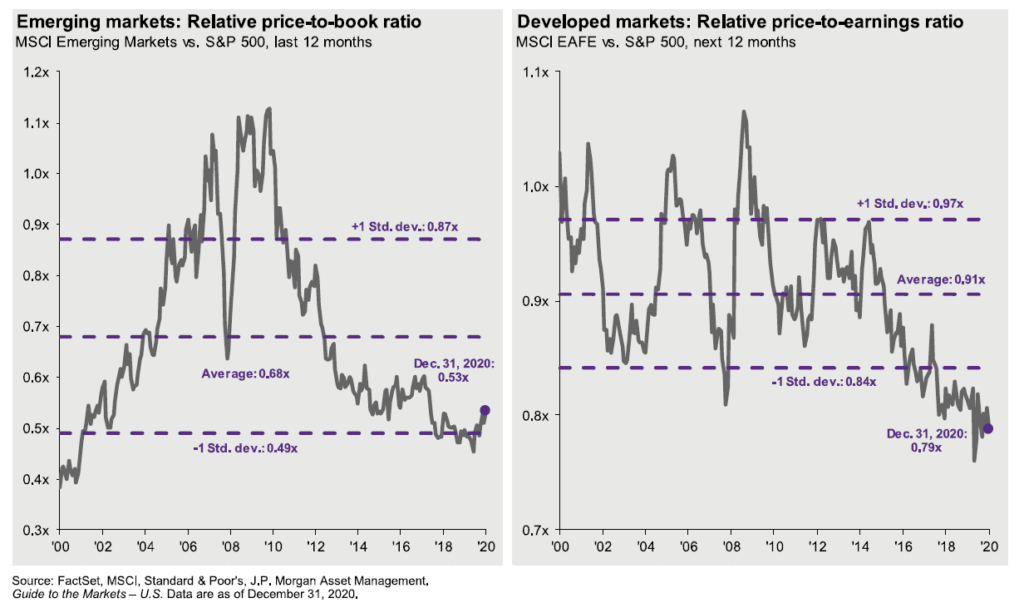

Emerging markets stocks are close to their post 2000 all-time low valuation relative to the S&P 500 and for non-U.S. developed markets (including Europe and Japan) they are at all time relative lows (next two charts). A post pandemic reflation/growth phase should favor these asset classes over most U.S. stocks. Lower relative valuations and higher equity risk premiums for non-U.S. stocks suggest a 2% to 4% greater return per year to owners of non-U.S. stocks for a number of years into the future.

Currency changes can add or subtract from these returns, so it makes sense to hedge some of the currency risk via mutual funds and ETFs that add a currency hedge overlay.

Fixed Income Investments

Fixed income investment yields in the U.S. generally fell last year. Short-term and longer-term interest rates declined in 2020 due to Federal Reserve policy actions to offset the COVID-19 induced recession.

The Fed is likely to keep short-term interest rates low for the next few years or until inflation takes a large unexpected jump. The Fed may also keep its QE program in place beyond 2021.

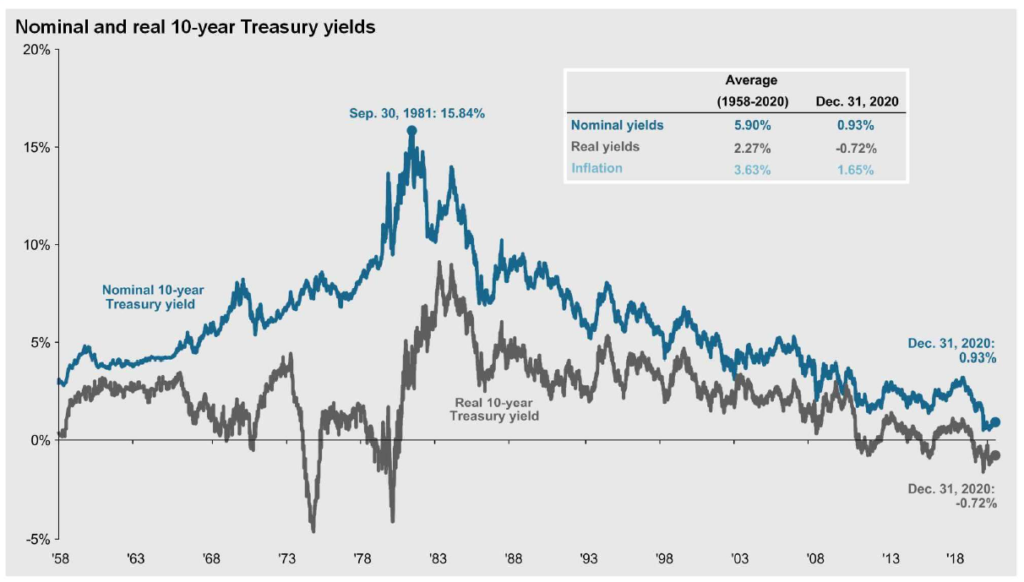

However, interest levels are so low now that the reward for investing in fixed income makes owning a long-maturity, high-quality bond quite risky. As the next graph shows (JP Morgan), the 10-year U.S. Treasury Note yield at year-end 2020 was only 0.93% and was negative when adjusting for inflation.

If interest rates should rise suddenly, bond prices will fall. For example, if the 10-year bond yield should rise 1%, then previously issued, lower-yielding bonds would need to drop 9.1% in price to compensate. With a current yield of just under 1%, it would take nearly 9 years of interest payments to make up for this price decline. This is a very long profit breakeven time. Longer than 10-year maturity fixed-rate bonds would fare even worse with an interest rate increase.

There are several alternatives to offset the risk of a potential rise in interest rates. One is to focus on short maturity bonds. Owning fixed income maturities of 2 years or less reduces the price risk and brings down the breakeven time for rising rates from years to months. Another is to own variable rate bonds where the interest rates are reset every 30 to 180 days. Nevertheless, for high quality U.S. offerings, yields are under 0.5% per year. So, these assets earn less than the inflation rate and are likely to stay that way for 2 to 3 years. Therefore, these assets are best used as a risk buffer, a place to hold money for pending withdrawals or until other investment opportunities arise.

Such low interest rates transfer value from savers and investors to borrowers. For firms and households, this current period is ideal to refinance loans to lower interest rates and monthly payments.

Accepting more credit risk is another way to boost returns in fixed income assets. The higher current interest rates paid on these reduces the breakeven time for owning these should interest rates rise.

High-yield bonds and bank debt floating rate securities yield close to or a bit above 4%. This is about 1% less than a year ago, and default/loss risk is still elevated, post-recession, so care must be taken in exactly what securities of this type are owned.

Convertible bonds appear attractive, although they act a lot like stocks and thus do not provide much of a risk buffer when stocks are doing poorly.

Non-agency (not government insured) mortgage-backed securities also offer attractive yields. They can offer returns 2-4% higher than Treasury note yields. With a strong consumer balance sheet and a healthy housing market, these non-agency residential mortgage investments offer a good balance of risk and return. Many also have adjustable interest rates or have short durations. The Federal Reserve did not provide any direct support for these assets last March, so their price recovery has been slower than for high-yield and corporate bonds. Therefore, these non-agency securities offer more price appreciation potential for 2021. However, mortgage loans made to shopping centers and hotels are still at risk of large losses. So, selectivity is paramount. Small banks also have exposure to these commercial real estate loans, so it may be too soon to invest in small banks.

Municipal tax-free bonds may benefit from an increase in federal and state tax rates, but many municipalities are under financial duress as a result of COVID induced budget deficits plus the burden of generous municipal pension benefits that were agreed to in better times.

Foreign bonds have a much wider range of interest rates, depending upon country of origin and whether they are issued in dollars or local currencies. Suffice to say some are very attractive while others are not. Additional details are available upon request.

Alternative and Hedged Asset Strategies

With interest rates so low, yields on high-quality fixed income assets cannot match a still low inflation rate. Therefore, it can make sense to find alternatives that offer a total return that can exceed the inflation rate and at the same time have much lower volatility than stocks or long-term bonds. In addition to credit-sensitive fixed income assets, discussed earlier, hedged strategies are often overlooked. Such strategies often use a long-short approach, going long the more attractive asset and going short the less attractive asset. Profits are made when the long asset outperforms the short asset and the hedge (being both long and short) tends to keep volatility low. Examples of this include merger arbitrage, convertible bond arbitrage and long-short various types of fixed income assets. There are many hedge funds that have the flexibility and expertise to follow these strategies. For those who do not qualify for or want to avoid hedge funds, there are a small number of accessible mutual funds that have been successful as well.

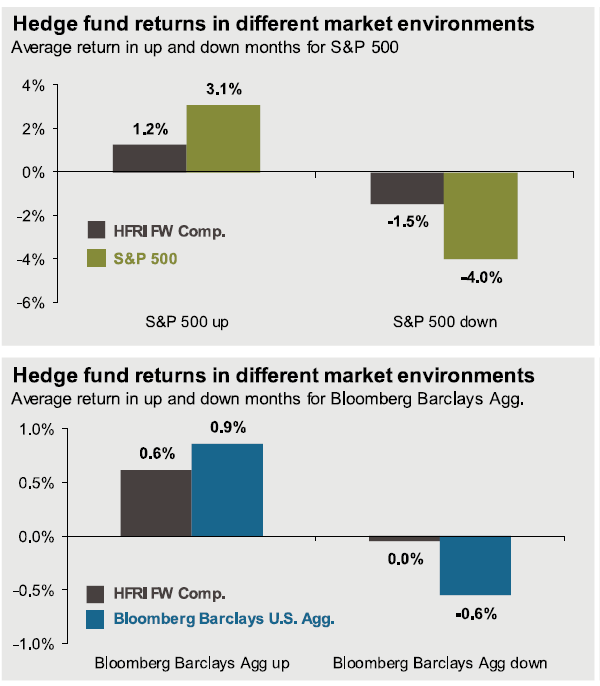

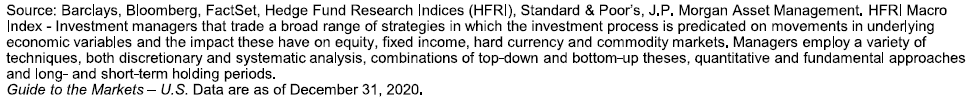

The HFR institutional fund weighted (equal-weighted) hedge fund index has underperformed both US stocks and bonds when those asset prices have been moving up, but have done much better when those asset prices were moving down. Hence, they have had superior risk-adjusted returns.

Alternative investment strategies provide another option. This category often includes owning private market investments (e.g., private equity, private debt), real estate, precious metals, and other commodities. Private market investments tend to have higher returns than for public stock and bond market returns due to the return premium required to hold illiquid assets.

Industrial commodities (oil, iron, copper) have shown increasing demand and prices are likely to trend up over the next few years as global economies improve. These commodities plus gold and silver benefit from both low interest rates and dollar weakness.

Commercial real estate is a mixed bag, with shopping centers particularly stressed now and into the future. Apartments are holding up well, but rents could stagnate until employment trends improve. Office buildings seem fine now, but when long-term leases expire, we may see more stress there. Hotels are very stressed, but those that cater to domestic leisure travel should begin to recover in 2021. There should be some bargains out there, but selectivity is the key.

Hedge fund and alternative strategies can be very diverse as can be the mutual funds following similar strategies. Considerable expertise is required for understanding pros and cons of various approaches, but we are happy to go into additional details as to why a targeted approach to these investments is warranted.

Conclusion

Annual return variation is expected to be high for stocks and less for fixed income investments. A double dip recession or major pandemic surge would likely result in lower returns. An acceleration in U.S. and global productivity, more domestic and foreign fiscal stimulus, improved trade, and longer-than-expected low interest rates and low inflation could result in better returns.

WESCAP will continue in its efforts to add value by following a disciplined asset allocation approach tailored to appropriate risks, with frequent rebalancings, and taking advantage of market and valuation trading opportunities. Income tax considerations will also be taken into account as appropriate.

For more details, please contact your WESCAP Group advisor.