Stock Market Update May 2022: Contrarian Indicators Suggest Strong Stock Market Returns 12 Months Hence

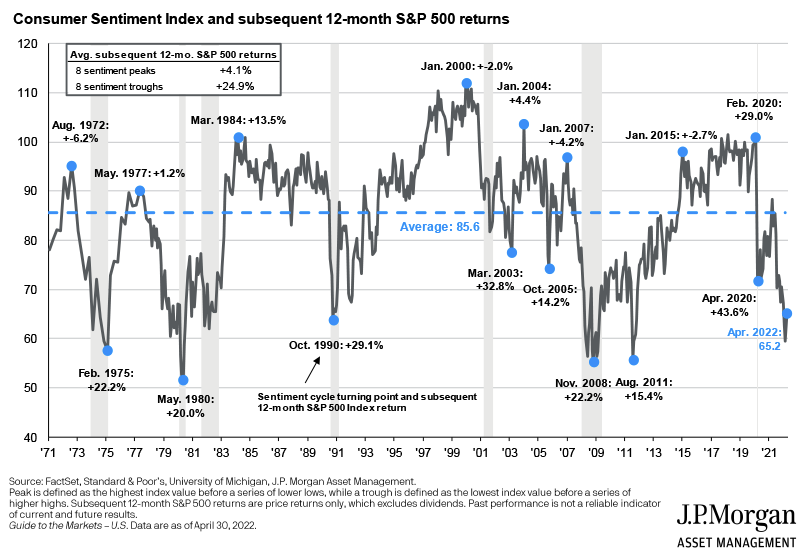

U.S. Consumer sentiment is so poor now (April 2022) that future stock market returns are expected to be higher than average. As can be seen in the chart below, when the University of Michigan Consumer Sentiment (confidence) Index has reached eight troughs in the last 51 years, the subsequent 12-month return of the S&P 500 stock index has averaged 24.9%.

In April 2022, the Consumer Sentiment Index reached a low only exceeded four other times. Such pessimism occurs during periods of extreme financial and economic distress. Within 12 months, conditions are expected to improve enough that pessimism wanes and stocks rally as a result.

The first two Consumer Sentiment (confidence) Index troughs occurred during the inflationary 70s and 80s which may most closely correspond to current conditions. The S&P 500 had total returns of 22.2% and 20% in the 12 months following those two troughs.

Weekly investor survey data from the American Association of Individual Investors (AAII) also show a contrarian stock market effect. When investors are least bullish and most bearish, then 6-month and 12-month stock market returns tend to be very strong.

On April 27, the survey indicated that only 16.4% of those surveyed felt bullish about stocks, which is just under 2 standard deviations below the long-term average. Those feeling bearish were 59.4% of those surveyed or nearly 3 standard deviations above the average level of pessimism.

When bearish sentiment was 3 standard deviations above its long-term average, then the median S&P 500 return the next 6 months and 12 months was 23% and 25.6%, respectively, and in none of the cases was the S&P 500 lower.

When bullishness was 2 standard deviations below its long-term average, then both 6-month and 12-month median returns were a positive 17.7% and 21.7%, respectively. Out of the 16 times this has happened in the past, none of the 6-month or 12-month returns were negative.

The current AAII sentiment information is here: https://www.aaii.com/sentimentsurvey and their study as a contrarian indicator is here: https://www.aaii.com/journal/article/is-the-aaii-sentiment-survey-a-contrarian-indicator?via=emailsignup-readmore.

Uncertainty is high with the Ukraine-Russia conflict being far from over, inflation still quite high, and interest rates rising. These are all reflected in the low current Consumer Sentiment and AAII Sentiment indexes.

Nevertheless, the conflict will eventually simmer down. Supply chain issues appear to be easing in some areas (e.g. shipping supply improvements). Inflation is likely to ease on a year-over-year basis as high CPI inflation readings from April-June 2021 are dropped off in the next few months and current inflation readings are showing some signs of improvement (e.g., decline in used car prices). If inflation shows some incremental improvement in the next 3 months, then interest rates may not ultimately increase as much as feared. If some of these conditions improve, then confidence and sentiment should be on the mend.

When consumers and investors are most worried is when stock sales reach a maximum and prices hit bottom. Once these investors have sold, then selling pressures decline and prices first stabilize and then begin to rise. While many uncertainties and problems continue to persist, stock prices can rise in these circumstances, hence the old adage that “markets climb a wall of worry.”

There are no guarantees that these contrarian indicators will work again this time, but history suggests that we should be holding or buying stocks now and not selling. Looking backward at past losses may suggest selling to avoid more losses. However, looking forward suggests doing the opposite.

In addition, having a sound asset allocation is required to ride out these periods of poor returns. Holding sufficient lower volatility assets as a loss buffer is prudent for all but the most aggressive investors. These lower volatility assets would include, cash, ultra-short maturity bonds, floating interest-rate assets and various hedged strategies. Avoiding expensive assets (e.g., popular growth stocks) and owning those with more attractive valuations (e.g., small-cap and value stocks) worked well in 2000-2002 during the dot.com bust and could work well over the next several years as well. Owning some inflation hedges, such as commodity-linked assets can help if inflation does not begin to decelerate in the near future.

Rebalancing portfolios—selling stocks when prices are rising, and buying when prices are declining adds both to longer-term returns and reduces risk at the same time.

Please contact your WESCAP advisor to discuss how this applies to you.