Economic and Investment Outlook for 2023

Will the U.S. experience a recession this year or shortly thereafter? In this report, we explore the outlook for recession and how stocks, bonds, real estate, and other assets are expected to behave. We discuss how investors should be positioned in 2023.

2023 Outlook Summary

- Economic Growth: Higher interest rates may result in a U.S. recession within 18 months. However, if the recent moderation in inflation continues, this may give cover for the Federal Reserve to cut interest rates this year and avoid a recession. Europe may already be in recession, although conditions could improve noticeably later this year. China’s abandonment of its Zero-COVID policy should be a net positive for global growth. Geopolitical risks add a destabilizing element, presenting downside risk to growth.

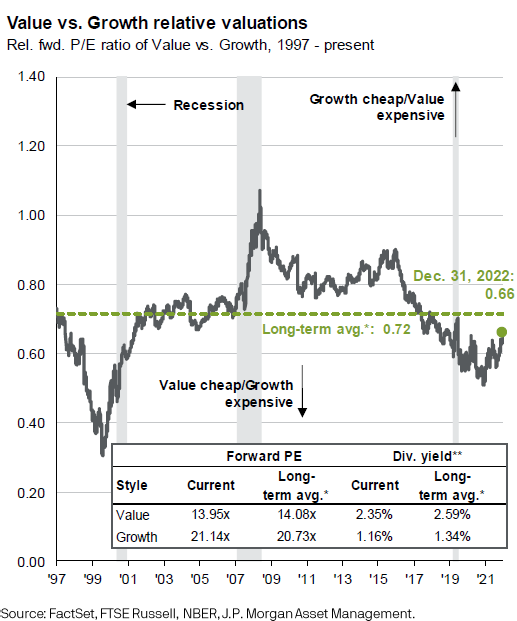

- U.S. Equities: The S&P 500 is now reasonably valued, absent a recession. Growth stocks are still somewhat expensive and value stocks are less expensive and thus expected to outperform this year as they did last year. Nevertheless, a possible recession suggests a more defensive stock and stock sector allocation than in past years.

- Foreign Markets: Economic conditions, cheap currencies, and attractive valuations make assets in many larger foreign developed and emerging markets attractive. Therefore, we continue to recommend a substantial allocation to assets linked to these countries—some currency-hedged and others, not currency-hedged.

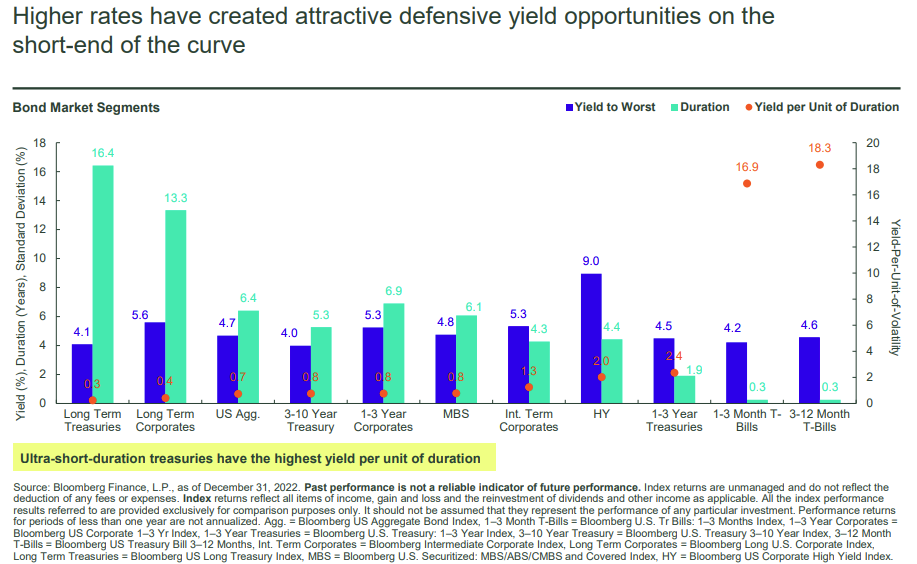

- Fixed Income: U.S. interest rates are expected to stabilize at higher yields early in 2023 and then perhaps decline later. This makes most high-quality fixed-income investments attractive this year, the complete opposite from a year ago. Very short-duration and adjustable-rate fixed-income assets are very attractive as they are rapidly capturing the benefit of rising interest rates. An increased allocation to these areas is warranted at the expense of all other asset classes and strategies. Credit-sensitive fixed-income assets continue to offer high yields, but if the risk of recession increases, then a pivot away from these is warranted.

- Alternative investments: These still have a place in portfolios due to lower correlation and volatility when compared to stocks and traditional bonds. Alternatives include hedged strategies and private investments. Mutual funds, ETFs, and hedge funds are all avenues for investing in this area.

COVID-19 Retreats and Geopolitical Risk Remains a Threat

COVID-19 no longer appears a threat to global economic growth. Vaccines, natural immunity and new medications have allowed businesses and governments to recover almost to pre-pandemic levels. A surge in service spending (e.g., travel, entertainment) has partially replaced the pandemic-induced goods and stay-at-home spending.

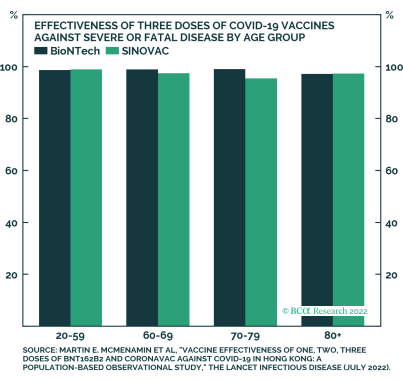

China abandoned its Zero-COVID policy in December. Supporting this move is the finding that China’s Sinovac vaccine appears only slightly less effective than western mRNA vaccines (left chart). China should therefore contribute to global growth in 2023 due to increased Chinese imports and exports. Improvement in global supply chains with respect to China should further reduce inflationary pressures.

Nevertheless, higher-than-anticipated global inflation, along with central banks’ “cure” of higher interest rates, threatens this growth. We stated in our Outlook last year that “our base case is that we expect the coronavirus pandemic to begin to wind down in the U.S. sometime before spring and that any new variants or surges will be less impactful.” We are happy to be correct in that assessment.

Nonetheless, geopolitical risk jumped to the forefront in 2022 as the Russian invasion of Ukraine helped trigger higher inflation, various material shortages, and a likely recession in Europe. This conflict appears far from over.

A polarized and split U.S. Congress means that very little legislation is expected—no material changes to income or corporate taxes, regulations, or new spending. However, the impending debt ceiling will likely result in political theatre brinksmanship. While we do not expect any major long-lasting damage from this, short-term stock and bond price gyrations are expected.

Conflicts are hard to predict in advance, but it is likely that destabilizing events will occur in the next few years. Events in China-Taiwan, the Middle East, Korea, and Russia, or with terrorist groups, protests and strikes, pose potential instability that would reduce global prosperity. The retreat of globalization and the resurgence of nationalism continues. From an investment perspective, unexpected negative developments can hurt long-term investment returns if investors overreact or can be neutral to positive to long-term returns if investors adapt to new conditions and take advantage of temporary asset price dislocations.

Reduced Inflation Outlook in 2023

The Russian invasion of Ukraine last year created shortages in oil, natural gas, grains, and various industrial metals. The resulting energy inflation severely impacted Europe, but higher energy costs were also experienced in the U.S. and elsewhere. In the U.S., high consumer demand and very tight labor conditions also added to inflationary pressures. In 2022, the Consumer Price Index (CPI) rose 6.5%. Earlier in 2022, inflation was even higher, triggering an aggressive Federal Reserve response of raising short-term interest rates by 4.25% in 2022.

Recently, U.S. inflation appears to be ebbing rapidly. The last 6 months of 2022 resulted in an annualized CPI inflation rate of only 1.8%. Falling energy prices (oil, gasoline, natural gas) drove most of this decrease. Fewer supply shortages across the globe have helped stabilize prices. If we look at more demand-driven “core” CPI, which excludes food and energy, the annualized inflation rate was 4.7% over the last 6 months of 2022, although it, too, was lower than in the first half of 2022. In our report from one year ago, we stated “overall inflation should drop to between 2.5% and 3.5% within 12 to 18 months”. This earlier forecast appears to be on target.

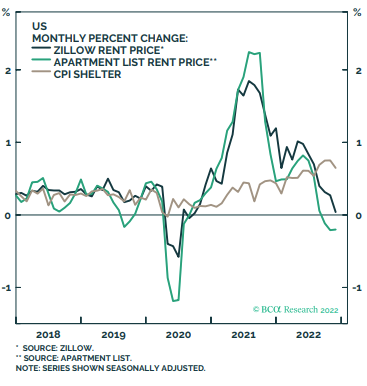

Note that residential “shelter” costs (i.e., rents) account for about 40% of the core CPI. Because shelter costs are determined by a survey of renters and rents are typically increased only every 6 to 12 months, these CPI shelter costs often lag current rental conditions by 6 months or longer. In the last six months of 2022, CPI shelter costs rose at an annualized rate of 8.5% and were showing no signs of slowing, thanks to the lag effect. However, new monthly rent data show rent increases close to zero (above graph). If we substitute current close-to-zero rental rate increases for the CPI shelter costs, then the last 6-month annualized WESCAP-adjusted Core CPI inflation rate falls from 4.7% to 2.2%. As official CPI data should reflect this real-time rental cost trend in the first 6 months of 2023, we expect official core CPI data to come down significantly by this summer, absent material increases in other costs.

Core CPI is important because it strips out supply-shock sensitive food and energy costs and thus is better at giving a truer picture of underlying demand-driven inflation.

Costs are indirectly reflected in the CPI as labor costs factor into what consumers pay for. Labor costs have been lagging behind inflation, so we don’t appear yet to be in a full-fledged wage-price spiral similar to that experienced in the 1970s.

Small businesses, the main driver of employment growth, plan on hiring fewer workers over the next 3 months (National Federation of Independent Businesses). Also, the employment participation rate rose from 62.1% in July to 62.3% in December, showing that more potential workers are entering the workforce, taking some pressure off wages. The 3 months ending in September showed wages increasing at just under 5% annualized—still high, but declining modestly. Given more recent data, we may find wage growth continuing to trend down in the next few quarters. If productivity can improve by just 1%, then wages would only contribute about 3%-3.5% to inflationary pressures, low enough that the Federal Reserve could lessen its current restrictive measures. As noted earlier, WESCAP-adjusted core CPI appears to be just over 2%, so businesses appear to be raising prices less than wages, putting some pressure on corporate profit margins.

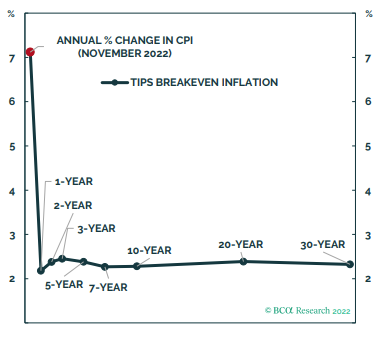

The difference between yields in U.S. inflation-adjusted Treasury bonds (TIPs) and regular Treasury bonds (left graph) indicates what bond investors believe future inflation will be. Bond investors currently are forecasting, with their money, current CPI to be modestly over 2% in late 2023. New data could move this materially. Supply shocks or unexpected price increases could result in higher than currently expected inflation. Nevertheless, current trends and expectations suggest that inflation will trend sharply lower this year.

Energy costs have come down since the first half of 2022, which is the main reason the CPI has been so benign over the last 6 months. However, an expected acceleration in Chinese growth, output cuts by OPEC, cessation of oil releases from the Strategic Petroleum Reserve, and underinvestment in oil/refining capacity could result in oil and gasoline prices beginning a new, slower-paced, energy price uptrend. A Russian-Ukraine lasting cease-fire and relaxation of Russian sanctions could cause energy prices to sharply decline, but this does not look imminent. Therefore, CPI may end up being slightly higher at 2.5% to 3% a year from now, but this would still be a vast improvement from early 2022.

Inflation has been running higher in most of Europe than in the U.S. due to even higher energy costs and a decline in the euro, increasing import costs relative to the U.S. Japan’s inflation has risen to over 3% in late 2022, also due to energy and currency issues. However, labor costs and labor conditions are more subdued in Europe and Japan and thus are less of a concern for long-term inflation trends. Nevertheless, higher global inflation has triggered higher global interest rates.

Interest Rates and Recession Outlook

The U.S. Federal Reserve began an aggressive series of interest rate increases starting in March 2022 in order to quell inflation. The Fed has raised the upper end of its Fed Funds rate target from 0.25% to 4.5% at year-end 2022 and set expectations of pushing rates to at least 5% in 2023. Energy supply shocks, supply chain constraints, “excess” consumer demand via pandemic-era government stimulus efforts, and a pandemic-induced drop in labor supply all contributed to the highest U.S. inflation in 40 years.

Increasing interest rates will only affect the “excess” demand component of inflation by raising borrowing costs for households and businesses. The demand destruction should be strongly experienced in industries sensitive to higher borrowing costs such as residential real estate and related services. Capital spending by businesses typically becomes more cautious in such an environment. Households tend to spend less as net worth declines. Stocks, bonds, and real estate prices are all adversely affected by higher interest rates, thus reducing household net worth and dampening consumer spending.

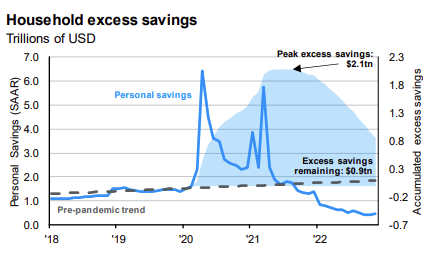

Consumers in aggregate still have about $900 billion of “excess” savings due to pandemic stimulus payments. But this is less than half the peak excess savings (left graph, JP Morgan). At current rates of spending, this is expected to be largely depleted by the end of 2023. Until then, consumer demand may surprise to the upside, despite higher interest rates. Therefore, 2023 recession risk is lowered by this “excess” savings. Furthermore, there are 1.7 job openings for every person seeking employment. Even if higher interest rates cause layoffs in certain sectors, employment may stay robust as workers just switch to currently unfilled jobs. So the scenario that higher interest rates will raise the unemployment rate and cool off wages may not occur in 2023. These factors decrease the probability of recession in 2023 and delay the recession risk into 2024.

Whether a recession occurs in 2023 or later, it is not expected to be a deep one. Households, businesses, and financial institutions are in much better financial shape than in 2008 (details upon request).

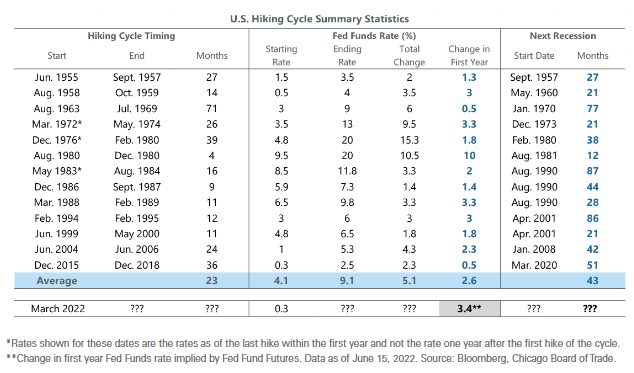

In the two prior cases of the Fed increasing interest rates in the first year by more than 3%, but less than 10%, a recession followed in 21 to 28 months, as can be seen in the following chart. If we use 20 months to 28 months as a realistic lag between the first Fed Funds interest rate increase and subsequent recession, this puts a possible recession between October 2023 and June 2024.

A near-5% expected total first 12-month Fed Funds rate increase would be the fastest rise since 1980. This severity of rate increase, especially from such a low base, could speed up the recession process. So it is possible that a recession may occur sooner than October. Many other indicators point to an upcoming recession, including a deeply-inverted yield curve, negative leading economic indicators and surveys of economists, among other indicators.

Nevertheless, a case can be made for no recession. The main cause for this “soft landing” would be because the Federal Reserve sees inflation coming down rapidly and not only pivots away from more interest rate increases, but begins to cut interest rates this year before a recession begins. The Fed talks tough about more rate increases and wanting to see unemployment rise to cool demand. They need to do this to bring down inflation expectations and they are succeeding when you look at the Treasury bonds’ breakeven inflation rates on page 4. However, they may pivot to lower interest rates if 2023 data suggests that wages and inflation are coming down close to their target and without having to meaningful boost unemployment. The Fed Funds futures market is, in fact, indicating modest rate cuts later in 2023. Wage growth can slow without a large jump in unemployment in the event that jobs available to each person seeking employment decline from 1.7 to about 1.0. However, if wage growth stays too high and if the Fed does not pivot to lower interest rates in the second or third quarter of 2023, then a U.S. recession looks more likely.

Historically, the Federal Reserve does not have a good track record of avoiding interest rate policy errors; it often raises and then cuts interest rates too late to avoid causing a recession. A close watch on this in 2023 is warranted, with an investor recommendation to hope for the best, but prepare for the worst.

Investment Implications and Positioning in 2023

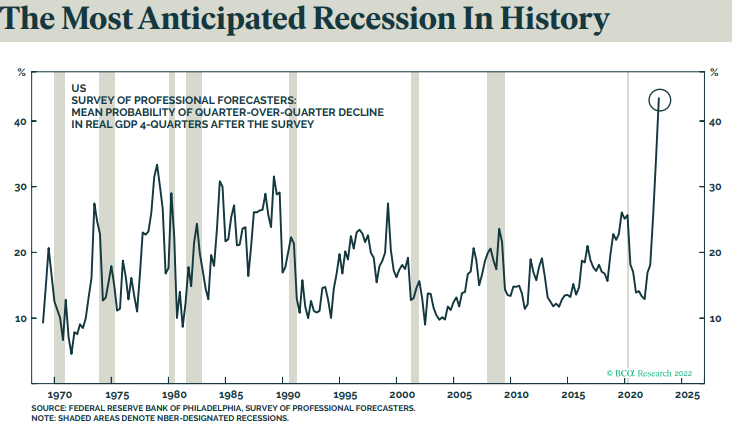

Stocks and bonds appeared to be pricing in a recession for most of 2022. This seems to be the most widely anticipated recession ever. The Michigan Consumer Sentiment (confidence) index declined to its lowest level ever in May 2022, largely mirroring high gasoline and food prices and higher mortgage and borrowing costs (all highly visible costs). Concerns that recession was imminent abounded, though they were premature.

Nevertheless, stock and bond markets fell as if a recession was about to occur. By the end of the third quarter of 2022, U.S. stocks (S&P 500) had fallen 23.9%. Long-term government bonds had fallen 30.1% due to higher interest rates. Note that one year ago in our Outlook report, we suggested “do not buy longer-term, high-quality bonds or C.D.s now, but wait for interest rates to rise. Focus on short-term or adjustable-rate fixed income securities.” This suggestion worked very well in 2022. Other interest rate-sensitive sectors, such as real estate (REITs) and the S&P 1500 growth stock index, fell 27.9% and 30.1%, respectively. (See this on why growth stocks are more interest rate sensitive: https://www.wescapgroup.com/2020/08/20/tech-bubble-deja-vu/). Foreign developed market stocks (EAFE index) fell 13.1% when measured in their native currencies and had much larger declines when measured in U.S. dollars.

Though assets were priced for a recession in 2022, the recession did not occur. Labor markets were too tight, energy prices retreated and inflation moderated, and households and businesses kept spending and increasing earnings in aggregate despite higher interest rates. Stock prices surged in the fourth quarter and longer-term interest rates retreated modestly as well.

Asset prices have not regained all of their 2022 losses as recession fears still persist. Nevertheless, many asset classes now appear to be more reasonably valued and the prospects for decent 3-to 5-year investment returns exist.

Fixed Income: Fixed income assets now offer reasonable yields, unlike a year ago. Early last year, 6-month T-bill yields were close to zero. Now they are yielding more than 4.5% (see far right blue bar above). They have almost no duration risk (risk of price declines as yields rise) and have the full backing of the U.S. government. As shown in the chart above, they offer the best yield per unit of duration risk. To a lesser extent, this is also true for money market funds, but not for most bank savings accounts and CDs as banks set their own rates, which tend to lag market-driven interest rates. Therefore, these short-duration, high-quality fixed income marketable securities deserve a larger than typical allocation to portfolios, whether we have a recession or not.

When and if a recession is imminent or underway, then we expect the Federal Reserve to cut short-term interest rates, and long-term interest rates should also trend down. Adding more duration-sensitive fixed income would then be in order. Intermediate-term, high-quality corporate bonds, and mortgage-backed securities (MBS) are good choices, with some, but not too much duration, and should rise in price if yields come down. We may add to these somewhat longer-duration fixed income assets as 2023 progresses.

High-yield bonds currently have attractive yields, but default risk rises if a recession occurs. Hence prices would be expected to decline entering a recession until the worst of the recession is over. Owning these plus low-duration bank loan securities for now appears reasonable as they benefit from waning current recession fears, but a prudent investor should be prepared to cut these back, as we have done already in portfolios.

U.S. and Global Stocks: If there is no recession, then most stocks are reasonably valued for good returns this year and beyond.

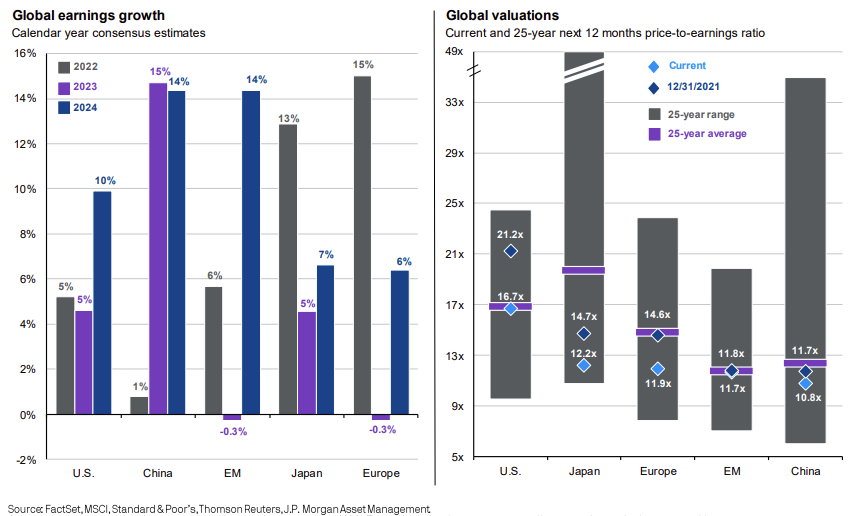

As shown on the above right chart, U.S. stocks are close to their 25-year average in price-earnings valuation and at a much lower valuation than a year ago. Japan and Europe are valued much lower than their 25-year averages. China and other emerging markets are just under or at their 25-year averages. Therefore, over the next 3 to 5 years (through any near-term recession), we would expect rates of return not unlike the past, with total returns of about 6-9% per year on average. An investor with more than a two-year time frame can look past recession risks, ignore short-term volatility, and continue to own global stocks.

Europe may already be in recession as energy shortages, high inflation, and reduced consumer and business purchasing power is more acute there than elsewhere. This can be seen by the negative 0.3% corporate earnings growth expected in Europe for 2023 (purple bar, above left-hand chart). Europe may be the first major region to go into a recession, which also would make it one of the first areas expected to exit a recession. This would make European stocks (perhaps excluding the UK) one of the areas to rotate to sooner rather than later.

Japanese stocks are very inexpensive, with expected 2023 growth similar to the U.S. The decline in the yen has given Japanese exporters a strong competitive advantage.

The recent abandonment of the Zero-COVID policy in China should reaccelerate trade with China, which should benefit both Japan and Europe more than the U.S.

U.S. 2023 corporate earnings are in the process of being revised downward, which may result in earnings falling in 2023. A strong dollar hurts exports and high and rising labor costs, along with much higher borrowing costs, appear to be hurting corporate profit margins. Strong revenue growth can offset these margin pressures, but probably not if an economic recession starts. In such a case, then a corporate earnings recession is also likely as would be a decline in stock prices for a period starting 6 to 8 months prior to the recession and most likely reversing mid-recession.

These negative margin pressures are much less evident outside the U.S., barring a return to very high oil and natural gas prices. In Europe, natural gas import prices have dropped by nearly 50% from August highs. A warm winter, new LNG port facilities, acceleration of “green” energy sources, and conservation have helped with this, and additional new non-Russian natural gas supply sources are in the works. Thus, we expect inflation to trend down rapidly in Europe and an economic and corporate earnings recovery to begin in the next few quarters.

China is expected to grow faster in 2023 as lockdowns and various pandemic-inspired restrictions are lifted. The property/construction bubble unwind is expected to be a drag on its economy and markets, but consumer demand is expected to rebound sharply, including travel and a return to strong goods consumption. Chinese stocks have done poorly for several years, although recent attractive valuations and positive growth expectations have resulted in recent outperformance.

Currencies play not only an economic role but also affect investment returns. The Japanese yen fell 12.2% against the dollar in 2022. Therefore, American investors owning Japanese assets lost 12.2% just from currency effects. The euro declined by 6% in 2022. Both increased by more than 10% during the last 3 months of 2022 as the dollar may have finally reversed its long-term uptrend. The yen looks very cheap when measured in purchasing power.

The dollar is a reserve currency and a flight-to-safety asset, so if a recession begins, the yen and euro could weaken once again. Nevertheless, once global growth begins to re-accelerate, then the yen and euro are expected to outpace the dollar. For U.S. investors, a prudent strategy is to partly currency hedge foreign stock exposure. This helped the portfolios we managed in 2022 when compared to an unhedged foreign stock strategy.

Value stocks (low P/E stocks such as most financials, energy, and utilities) outperformed growth stocks in 2022 by nearly 23.2%, clearly reversing growth stock 2015 through 2020 outperformance. In our Outlook report from one year ago, we suggested that “Value stocks—industrials, financials, energy, etc.—are much more attractive than growth stocks”. This was certainly true in 2022.

Despite this 2022 outperformance, value stocks are still cheap relative to their long-term averages and to growth stocks (left graph). The dichotomy between value stocks and growth stocks exists in foreign stocks as well.

For the next 3 years owning value stocks will likely be rewarded more than owning growth stocks. However, a recession accompanied by a decline in interest rates is likely to favor firms with steady earnings growth over more cyclical firms for perhaps six months or longer. As we don’t know exactly when a recession will begin, if at all, a prudent investor should consider a value-tilted stock approach that should have reasonably consistent earnings, even in a recession (a growth at a reasonable price strategy). These defensive stocks could include many healthcare stocks, utilities, and insurance firms, among others. Banks, industrials, and small-cap stocks may suffer more prior to the early stages of a recession, but should also lead when exiting a recession. Energy stocks usually do poorly right before a recession, though for reasons pointed out earlier, they may not be as negatively impacted as in previous economic downturns. Defensive-oriented stocks, mutual funds, and exchange-traded funds (ETFs) are abundantly available so it is not difficult to own a stock portfolio with these desired characteristics.

In 2001, a shallow recession occurred. Growth stocks were still expensive in 2001 as the post-dotcom extremely high valuations had not sufficiently unwound, and thus growth stocks did poorly that year. However, value stocks, which held up well in 2000 were also able to outperform growth stocks in 2001 despite a recession. Although earnings in value stocks are adversely impacted in a recession, their large valuation advantage in 2001 more than offset any earnings weakness. While 2023 valuations are not as extremely divergent as in 2001, we see a similar parallel that could favor value stocks this year and next year over growth stocks, even in the face of a mild recession.

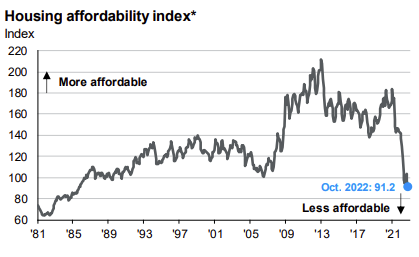

Real estate: Residential real estate prices surged during the pandemic as work-at-home and movement from high-density to more affordable lower-density locations took place. Mortgage rates plunged as the Fed’s low rate and asset-buying policies assisted buyers. Lower interest rates absorbed some of the effects of higher real estate prices. However, mortgage rates have recently surged, causing affordability to hit its lowest point since the early 1980s when mortgage rates commonly exceeded 12% (above graph, JP Morgan). Such a low affordability reading often presages a real estate recession.

However, the situation is not as dire as it was in the 2007-2009 period. Mortgage quality is generally good, housing inventory is not excessive, and very strong employment conditions and stronger household balance sheets support a thesis of only moderate home price declines and avoidance of widespread mortgage defaults. Several economic housing forecasters put price declines at 0%-10%, though if a recession occurs this is expected to rise to 10%-20% (details available upon request). If mortgage rates plunge in a recession, this will alleviate some downward price pressures, assuming unemployment doesn’t surge too much. Price declines of 5%-10% seem most likely over the next 24 months, so selling now and delaying purchases for a year or two is recommended for those contemplating either buying or selling. Those regions that had the strongest appreciation in the last two years should expect to fall the most. If high mortgage interest rates (over 6%) persist into 2025, then prices could decline further.

Commercial properties are also affected by higher mortgage rates, making them less affordable. Cap rates are expected to rise, putting pressure on prices. Rising rents can offset some of this, though, as noted before, it appears that residential rents may have topped out for the near term. Office rents have partly recovered, and hotel daily rents have rebounded strongly, though both are recession-sensitive.

Publicly-traded real estate investment trusts (REITs) had a negative total return of 25% for 2022, reflecting all of these negative developments. This decline closely tracked losses on long-term bonds as interest rates rose. This suggests that REITs are not yet cheap, but could become so with either another 10% in price declines or if longer-term interest rates show a significant and lasting decline.

The REIT market trades every business day and thus reflects the current sentiment of buyers and sellers of real estate assets. However, private real estate does not trade daily and often reflects the divergent valuation perspectives of buyers and sellers. When buyers demand a lower price, the seller simply does not have to sell, so no transaction occurs and prices appear static, whereas that is not really the case. Private real estate prices tend to move slowly and with large lags to the REIT market. It can take years and circumstances in which the seller can no longer wait to sell for actual selling prices to accurately reflect fundamental changes. So, as with residential real estate, it pays to wait for better pricing if one is a potential buyer and the reverse if one is a potential seller of private real estate. Nevertheless, if interest rates come down enough in the next 12-15 months via either a soft landing or mild recession, then we may not see private real estate show the same level of price declines as was experienced by REITs in 2022.

Hedged and Alternative Assets and Strategies: Some assets are thought to be good inflation hedges. These include tangible assets like gold and other commodities. This might be true for very long periods of time (decades) or for countries that experience hyperinflation (1920s Germany), but the correlation of these assets to a normal range of inflation (2-7%/year) is low in the short run. These may provide some inflation protection in some periods and fail in others. In 2022 the record was mixed. Energy assets did quite well, but gold did poorly. Neither accurately tracked U.S. inflation. They nevertheless tend to have lower correlations to stocks and bonds and can provide decent diversification benefits to a portfolio. Commodities and precious metals have typically underperformed stocks in the long run, as they have no earnings and pay no interest, and growth in demand for these physical assets tends to be less than overall global economic growth. But there can be cycles in which these assets can be attractive.

Owning assets or employing strategies that are not highly correlated to stocks, bonds, inflation or interest rates can have an important role in portfolios. Various hedge fund strategies attempt to hedge out traditional stock or bond market risks. Such strategies often use a long-short approach, going long for the more attractive asset and going short for the less attractive asset. Profits are made when the long asset outperforms the short asset, and the hedge (being both long and short) tends to keep volatility low. Examples of this include merger arbitrage, convertible bond arbitrage, and long-short allocations to various types of stock and fixed-income assets. There are many hedge funds that have the flexibility and expertise to follow these strategies. For those who do not qualify for or want to avoid hedge funds, there are a small number of accessible mutual funds that have been successful as well.

Alternative illiquid investment strategies provide another option. This category often includes owning private market investments (e.g., private equity, private debt, art, farmland). Private market investments tend to have higher returns than public stock and bond markets due to the return premium demanded to hold illiquid assets. There are a number of hedge funds and private investment vehicles that focus on these types of assets. Additionally, there are some publicly-registered closed-end and interval mutual funds that offer ownership in some of these non-liquid assets.

Hedge fund, illiquid, and alternative strategies can be very diverse, as can the mutual funds and ETFs following similar strategies. Considerable expertise is required for understanding the pros and cons of various approaches. We intend to hold a number of these in various portfolios and we are available to discuss these investments in more detail.

Conclusion

Volatility is expected to remain high for stocks with some stock sectors and countries experiencing positive returns in 2023, with others struggling, particularly if a recession is brewing later this year or early next year. The 3-5 year outlook is better since this would include any post-recession recovery. Value stocks, small stocks, and foreign stocks offer the best prospects of above-average returns over this 3-5 year period, although this would likely reverse during a global recession. For 2023, a somewhat defensive posture is warranted. Long-term higher-quality bonds may be approaching an attractive buy point in 2023, while high-yield bonds and loans may be facing a number of headwinds. Short-term and variable-rate, high-quality fixed-income investments are currently very attractive due to high yields and low risks. Alternative and hedge fund-like assets may provide reasonable returns and offer diversification from traditional stocks and bonds.

WESCAP will continue in its efforts to add value by following a disciplined asset allocation approach tailored to appropriate risks, with frequent rebalancing, while taking advantage of market and valuation trading opportunities. Income tax considerations will also be taken into account as appropriate.

For more details, please contact your WESCAP Group advisor.