Cybersecurity and Protecting your Assets from Thieves Online

At WESCAP, we are constantly thinking about the security of your assets. This includes avoiding permanent investment losses, as well as avoiding fraud and theft.

With the financial system more dependent than ever on the internet and software that contains exploitable bugs, security has never been a bigger issue than it is today.

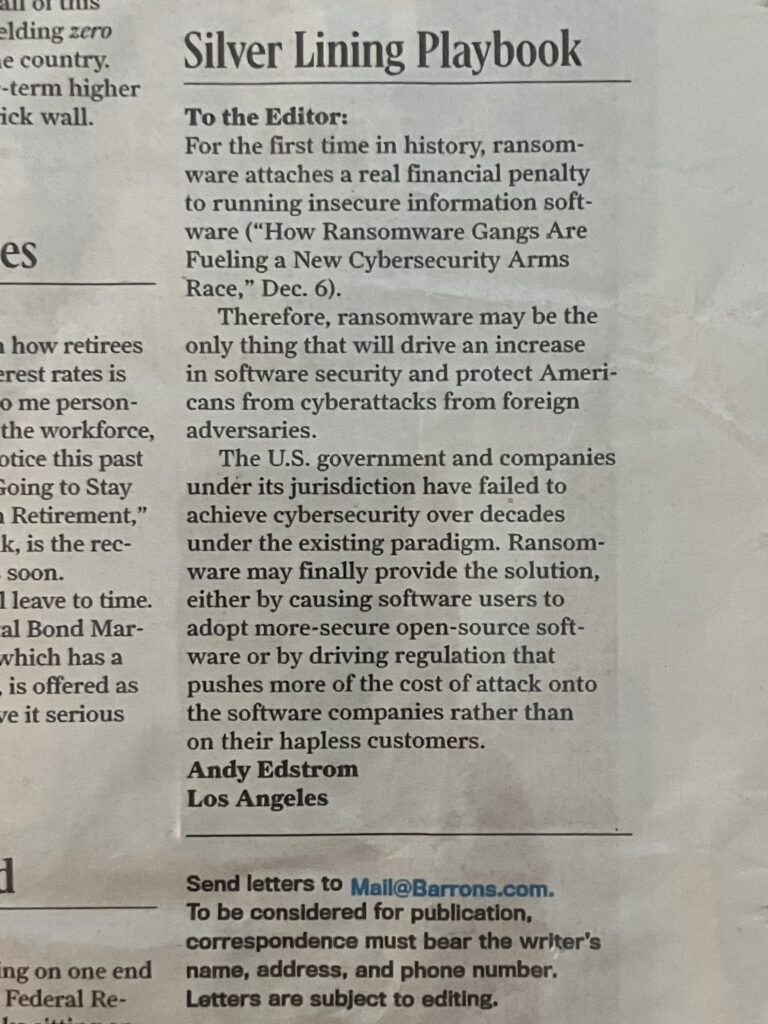

On this topic, Barron’s recently published a letter by WESCAP’s Andy Edstrom, CFA, CFP®. That letter can be seen below.

Andy observed that a major benefit of ransomware (yes, benefit!) is that it imposes a cost on insecure software. While this is a plague on its victims today, in the long run, it should result in more patches to insecure software. This will make us all more secure against individual hackers, hostile governments, and everything in between.

While ransomware is a reality today, we do not have to look very far into the future to see another rising risk to the security of your assets. Possibly as soon as this year, we expect to see rapidly-rising cases of fraud and attempted theft of client assets enabled by artificial intelligence.

The latest AI models allow an individual’s voice to be reconstructed from a very small sample of spoken words. Andy has observed that he has received a significantly increased number of spam phone calls. He picks up the phone and the caller does not announce themselves or play any automated robocaller script. It is just silence. He cannot help but wonder if any of these callers are phishing for him to start talking (“hello, who’s there?) in hopes of collecting a voice sample in order to construct a fake model of his voice to use to steal his assets. To avoid this outcome, our advisors have activated 2-factor authentication (“2FA”) on their investment accounts. We strongly advise you to contact Schwab and do the same if you have not done so already.

With new technological advances, it can be easy to forget that scammers still also use time-tested fraud techniques, such as check washing. Electronic transfer using a 2FA login continues to be the most secure method of transferring funds. However, WESCAP recognizes that e-transfers are not always an option, such as with Schwab Qualified Charitable Distributions from IRA accounts (unless done by wire). A simple way to combat fraudulent check washing is to write checks using a Uni-ball 207 gel pen. Check washers have difficulty removing the Uni-ball 207 pen’s gel ink with solvents compared to other types of pens. If you do not already have one, please contact us for a complimentary Uni-ball 207 pen with WESCAP’s logo.

The game of cybersecurity and fraud avoidance is an ever-evolving one. Make sure you are at least one move ahead of the thieves!

As always, please feel free to contact WESCAP at (818)563-5170 or send us a message if you have any questions about these items or if you would like to schedule a time to talk about your specific situation.

WESCAP Group