Don’t Get Caught Without Enough Homeowners Insurance Coverage!

Given the recent wildfires in California, flooding in Florida, and other natural disasters throughout the United States, homeowners should be prepared for future disasters. Climate change, rising property costs, inflation and the risk of insurers refusing to provide or renew coverage are leaving many homeowners in jeopardy of being underinsured. Homeowners should insure the total replacement value of their property. Those carrying less than the recommended amount of coverage are at risk of cash shortfalls and in some cases only partial reimbursement for damages.

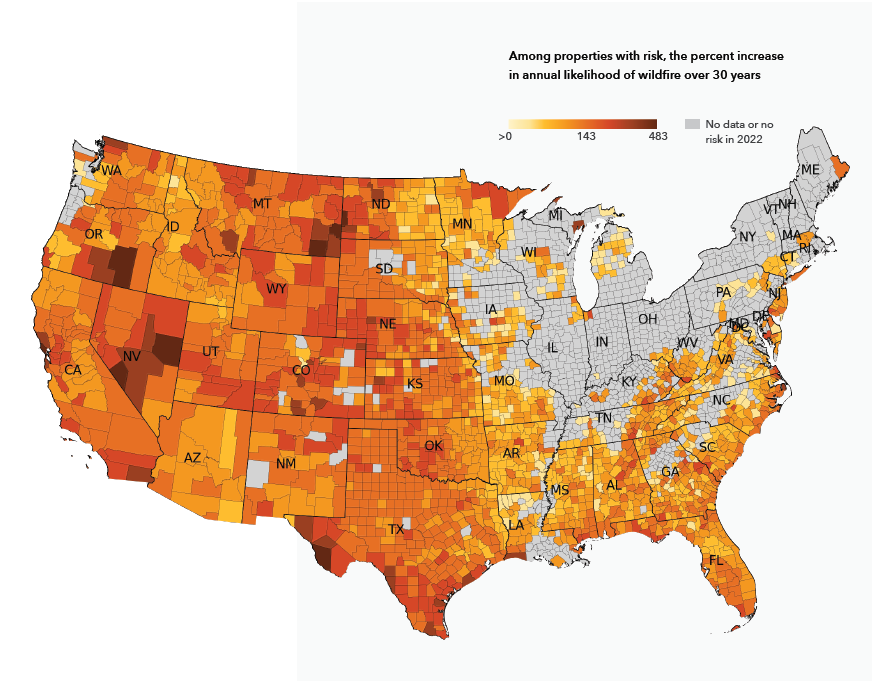

First Street Foundation, a non-profit research group comprised of 180 leading researchers from 42 top academic institutions, regularly examines the economic impacts and risks of flooding and wildfires across America. According to Jeremy Porter, chief researcher at First Street Foundation, “On average, the burn probability — the likelihood of the risk of wildfire — is about doubling over the next 30 years, and that’s across the country,” (Wigglesworth). The graph found below illustrates the percentage increase in the annual probability of a wildfire nationwide over the next 30 years.

(Source: First Street Foundation. “The 5th National Risk Assessment: Fueling the Flames,” 5/16/22)

Fire damage, including wildfires, is largely covered as a basic peril in most homeowners insurance policies. Nonetheless, fire coverage may be excluded in some high-risk areas. Insurers may be reluctant to renew previously established policies in high-risk areas, and when they do will often increase premiums substantially. You can check with your state insurance department for tips on finding insurance policies, comparing premiums, and comparing coverages. If individuals are unable to obtain a homeowners policy, they may need to use a state-administered FAIR Plan, which provides a limited amount of insurance coverage at a higher cost to policyholders. Additionally, you can check with your insurance provider for recommendations on retrofitting your home to protect yourself from fire damage and lower your monthly premiums.

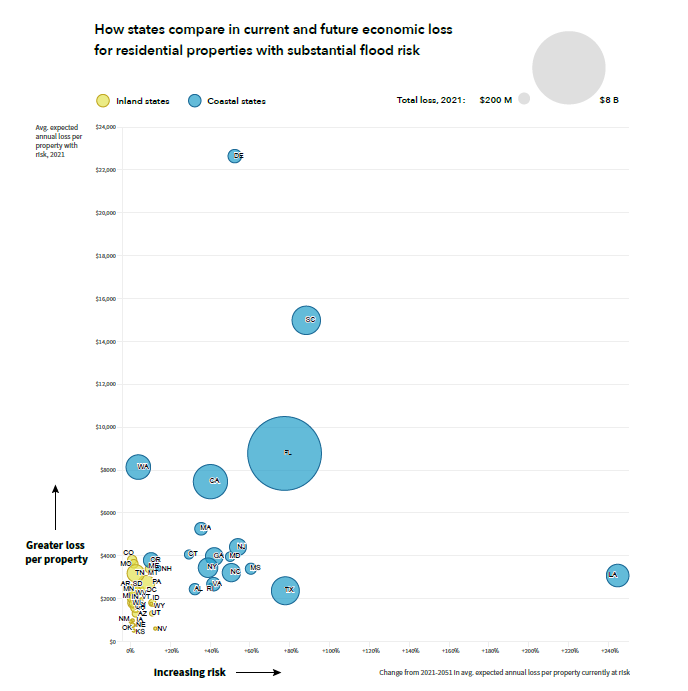

Recent news headlines have also highlighted the devastation in South Florida caused by hurricanes and hazardous weather events. Coastal communities maintain the greatest current and future risk per property of potential losses due to flooding. The higher degree of risk in these areas can be attributed to an anticipated rise in sea levels in coalescence with shifting cyclonic activity.

(Source: First Street Foundation. “The Cost of Climate: America’s Growing Flood Risk,” 2/22/21)

Coastal areas such as California may also be at risk from tsunami damage caused by earthquakes. Inland states are expected to see substantial increases of flood risks outside of the Federal Emergency Management Agency’s (FEMA) designated Special Flood Hazard Areas (SFHA), stemming primarily from increases in extreme weather events over the next 30 years. Flood coverage is not included in basic homeowners policies; still, lenders may require homeowners to obtain flood insurance if they reside in a designated Special Flood Hazard Areas. Flood insurance can be obtained through the National Flood Insurance Program (NFIP) at: https://www.floodsmart.gov/. The NFIP can help you to locate an insurance provider in your area and provide advice on retrofitting your home to mitigate flood risk and lower your monthly premiums. Due to the increased risk in flooding over the next 30 years, flood insurance should be considered even if you live in a non-designated flood hazard zone.

In an effort to inform the public of their property-specific flood and wildfire risk information, First Street Foundation provides free data access for 145 million US properties at their risk factor website: https://riskfactor.com/. For detailed reports on their findings on wildfire and flooding risks, please visit their website at: https://firststreet.org/.

In 1989, the Loma Prieta earthquake shook California for roughly 20 seconds, registering 6.9 on the Richter scale and causing direct damage estimated at $6.8 billion. The third iteration of the Uniform California Earthquake Rupture Forecast (UCERF3) estimates that over a 30-year period, beginning in 2014, “the likelihood for magnitude 6.7 and larger earthquakes somewhere in the entire region remains near certainty (greater than 99 percent),” (Field). Earthquake coverage is not included in basic homeowners policies either, but in California residential earthquake insurance can be acquired through the a publicly managed non-profit California Earthquake Authority (CEA). The CEA works with residential insurance companies to provide coverage to homeowners and offers information on their website, https://www.earthquakeauthority.com/, including earthquake risk by county. The CEA also offers a discount on premiums for policyholders that complete a recommended seismic retrofit on their residence. For those at risk of earthquakes outside of California it is recommended checking with their state insurance department for coverage recommendations.

Homeowners should aim to carry property insurance with a face value equal to the total replacement cost of their property. Homeowners that carry less than the total replacement value of their property are at risk of cash shortfalls in the event of an emergency. Furthermore, if you do not hold the minimum amount of insurance required by underwriters, you are at risk of receiving only partial reimbursement for damages. Insurance companies require homeowners carry a minimum amount of coverage, in most cases at least 80% of a residence’s replacement cost in order to be reimbursed for 100% of their partial losses. If homeowners do not meet the minimum coverage requirements, they will only receive partial reimbursement for damages. The partial reimbursement will be equal to the greater of the actual cash value of the damaged property, including depreciation adjustments, or a payout based on the following formula: (insurance carried/insurance required) x (amount of loss – deductible). The rising cost of housing and the effects of inflation on the prices for materials and labor has resulted in many homeowners to falling below the recommended 100% replacement level of property insurance, and even more concerning below the 80% minimum required by insurance companies to receive total reimbursement for their partial losses.

Other common insurance policies that should be considered include a personal automobile policy, inland marine coverage (personal property), and watercraft insurance. Additionally, a Personal Umbrella Liability Coverage Policy is recommended for individuals with valuable assets that may be targeted in a lawsuit. The standard Umbrella policy provide $1 million in coverage, and requires the policyholder maintains a minimum amount of underlying liability coverage. It is encouraged have enough total liability insurance to cover your net worth in case of a negligence lawsuit against you or your family from an incident that occurs on or off of your property.

Please contact your WESCAP advisor for more information how this applies to your current situation.

Sources

- California Department of Conservation. “The 1989 Loma Prieta Earthquake.” California Department of Conservation, https://www.conservation.ca.gov/cgs/earthquakes/loma-prieta

- Field, Edward. “Uniform California Earthquake Rupture Forecast 3: A New Earthquake Forecast for California’s Complex Fault System.” US Geological Survey, 2014, https://pubs.usgs.gov/fs/2015/3009/

- First Street Foundation. “The 5th National Risk Assessment: Fueling the Flames.” First Street Foundation, 5/16/2022, https://firststreet.org/research-lab/published-research/article-highlights-from-fueling-the-flames/

- First Street Foundation. “The Cost of Climate: America’s Growing Flood Risk.” First Street Foundation, 2/22/2021, https://firststreet.org/research-lab/published-research/highlights-from-the-cost-of-climate-americas-growing-flood-risk/

- Wigglesworth, Alex. “California properties at risk of wildfire expected to see sixfold increase in 30 years.” Los Angeles Times, 5/16/2022, https://www.latimes.com/california/story/2022-05-16/california-properties-at-risk-of-wildfire-expected-to-grow