WESCAP Q2 2024 Quarterly Commentary

The portfolio results for the second quarter of 2024 were mixed. Treasury bonds decreased by approximately 2.2% as interest rates rose, negatively impacting many asset classes, though not all.

The S&P 1500 Growth Stock Index increased by 8.6% over the quarter, primarily driven by a handful of mega-cap growth stocks, including Amazon, Nvidia, Google, and Meta. In contrast, the S&P 1500 Value Index and the Russell 2000 (small caps) decreased by 2.3% and 3.3%, respectively.

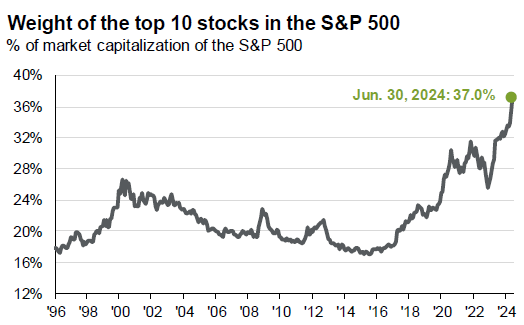

This marked divergence in performance between the “average” stock

and the mega-cap stocks (the largest 10 companies in the S&P) is pronounced

and reminiscent of the period from 1999 to mid-2000, just before the peak of

the dot-com bubble. As illustrated in the subsequent chart, the largest 10

stocks now comprise 37% of the S&P 500’s value, significantly surpassing

the nearly 27% weighting in 2000.

The forward price-earnings (P/E) ratio for these top 10 stocks is currently at

30.3, reflecting a 48% premium compared to their average P/E ratio since 1996.

In contrast, the remaining 490 stocks in the S&P 500 trade at a P/E ratio

of 17.6, only a 12% premium over their historical average (Source: JP Morgan

Guide to the Markets, June 2024, p. 11).

If the valuation of the top 10 stocks reverts to their long-term average P/E ratio, this could lead to an average stock price decline of 32% for these stocks. Should the other 490 stocks break even, the S&P 500 could see a 12% loss due to the top 10 stocks alone.

While it is possible for these 10 stocks to continue outperforming for the next 3-18 months and become even more overvalued, akin to the 1999-2000 period, historical evidence suggests that a significant price decline in mega-cap stocks is likely within a 2-5 year timeframe. Consequently, these top stocks—and the S&P 500 overall—may underperform compared to other U.S. stocks, foreign stocks, and most other asset classes. Investors are advised to exercise caution regarding excessive investments in mega-caps, growth stocks, and the S&P 500.

As always, please feel free to contact your WESCAP advisor if you would like to discuss any of this further.