WESCAP Economic and Investment Outlook for 2025

Will inflation reaccelerate after declining significantly last year? Will this cause interest rates to rise again, putting stress on borrowers and the economy? Are U.S. stocks priced to perfection, so that any less-than-perfect outcome will cause a sharp decline in prices? Will the new Republican-led federal government help or hurt the economy and investment assets? In this report, we explore these topics. We discuss how investors should be positioned in 2025.

2025 Outlook Summary

- Economic Growth: Higher long-term interest rates may result in a slowing economy. However, employment and household finances continue to be resilient. As a result, recession risk is not pronounced, but cannot be ignored as a tail-risk.

- U.S. Equities: The S&P 500 is expensive due to high valuations on the 10 largest companies. Other U.S. stocks are a bit overvalued, but not in dangerous territory. Higher interest rates often impinge upon stock prices. These high valuations historically have resulted in sluggish future returns for U.S. stocks. Therefore, emphasizing a more valuation-sensitive stock allocation is warranted.

- Foreign Markets: A decline in foreign currencies, and historically attractive valuations make assets in many larger foreign markets worth considering. However, looming tariffs and weak growth present near-term risks. Short-term, we are cautious and suggest using significant currency hedging. A more positive stance is likely later.

- Fixed Income: U.S. short-term interest rates have declined and may stabilize close to current levels. Long-term interest rates recently increased due to inflation and budget deficit concerns. These “higher for longer” interest rates make most high-quality fixed-income investments attractive this year. Very short-duration and adjustable-rate fixed-income assets are also attractive, as prices are not sensitive to interest rate shifts. Long-term interest rate exposure can result in gains or losses depending upon interest rate shifts.

- Geopolitical Risks: Russia and China continue to create global instability and are a drag on government finances and global growth. Tariffs can create shortages and additional inflation as well as trigger higher global unemployment.

- Alternative investments: These still have a place in portfolios due to lower correlation and volatility when compared to stocks and traditional bonds. These can outperform most other assets during times of turmoil. Alternatives include commodities, hedged strategies (e.g. merger and convertible bond arbitrage) and private non-traded investments. Mutual funds, ETFs, and hedge funds are all vehicles for investing in these assets.

Economies, Markets still at Risk due to Geopolitical Turmoil

Geopolitical risks remain high. Commodity prices are distorted, and energy shortages continue due to the Russian invasion of Ukraine. Food output and distribution is also impacted. Europe continues to struggle to adapt, and its economies are weak, with many teetering on recession. The retreat of globalization and the resurgence of nationalism continues. These all can detract from economic growth and investment returns, and increase populace discord and global tensions.

China continues its slow expansion of military and economic influence. A potential trade war looms with the U.S, which could accelerate inflation and sap U.S. and global growth.

A Republican-majority federal government is likely to implement many changes over the next few years. Tax cuts will stimulate U.S. growth, but also expand the federal deficit and are likely to cause interest rates to stay higher for longer. High new tariffs can cut the federal deficit, but likely at the cost of higher inflation and lower global growth, including for the U.S.

Federal deregulation should provide a short-term fiscal stimulus for many industries, which should be a net economic positive. Longer term, we are uncertain that deregulation will boost growth as less regulation could result in unexpected adverse consequences.

U.S. immigration policy will likely be more restrictive, causing a mild workforce shortage in some industries, which would negatively impact prices, productivity, and inflation. Nevertheless, we do not expect that any new immigration policy will be easy to implement on a massive scale, and thus the impact will be muted.

Cuts to various federal departments and some possible layoffs may provide some modest budget relief, plus some deflationary pressures and increase the labor supply. Details will matter.

Additional implications regarding the Republican federal elections sweep can be found in our earlier report here: https://www.wescapgroup.com/2024/11/19/significant-tax-economic-and-investment-implications-of-the-federal-republican-elections-sweep/.

Inflation, Tariff, and Interest Rate Risks Escalate

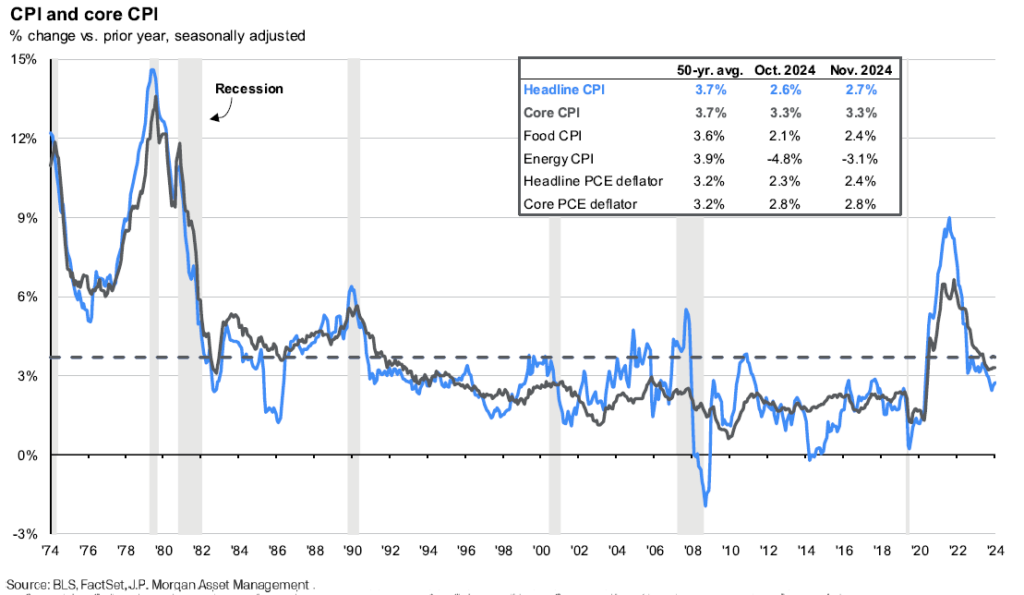

Over the past two years, headline inflation, as measured by the Consumer Price Index (CPI), has seen a significant decline, dropping from 7.1% in November 2022 to 2.7% in November 2024.

In the last year alone, headline inflation has decreased by 0.9%, down from 3.6% in November 2023. However, core inflation (black line in prior graph), which excludes volatile food and energy prices, remains elevated. Since August, this measure has come in at 0.3% per month (3.7% annualized) each month, which is greater than the prior 3 months. Therefore, core inflation has stagnated at a higher-than-expected level. Transportation costs, medical care services, food away from home, and “shelter” costs are the main factors in inflation staying sticky. High strong consumer demand appears to be the main impediment to inflation reaching the Fed’s 2% target. Unless there is significant weakness in employment or wages, this higher inflation rate could persist for some time.

Additional stimulus from government deregulation, additional tax cuts, and deficit spending can stimulate inflationary pressures further. These are reasons why long-term interest rates moved higher. The 10-year Treasury note yield rose from 3.8% at the end of September to 4.6% at year-end and to 4.8% as of January 10 this year. This nearly 1% rise in longer term interest rates reflects new concerns about inflation, and to a larger supply of new government debt being issued to fund current and expected federal deficits.

These higher Treasury interest rates translate to higher rates for mortgages, car loans, and other consumer and business lending rates. These tend to slow economic demand and upset pricing in stocks and other financial assets. In December alone, the 20+ Year Treasury index return was negative 6.0%. The S&P 500 lost 2.4% and the more economically-sensitive Russell 2000 (small stocks) and NAREIT (real estate) indexes lost 8.3% and 8.0%, respectively.

These higher longer-term interest rates were preceded by the Federal Reserve cutting short-term interest rates, starting in September. This and post-election optimism resulted in large financial asset gains in November, which reversed in December as the increase in longer-term interest rates more than offset the Fed’s earlier interest rate cuts.

Additionally, there were expectations of the Fed cutting interest rates by another 1% or more in 2025. However recent higher-for-longer inflation expectations have decreased this expectation to a range of 0% to ½% cuts to the 2025 Fed Funds interest rate.

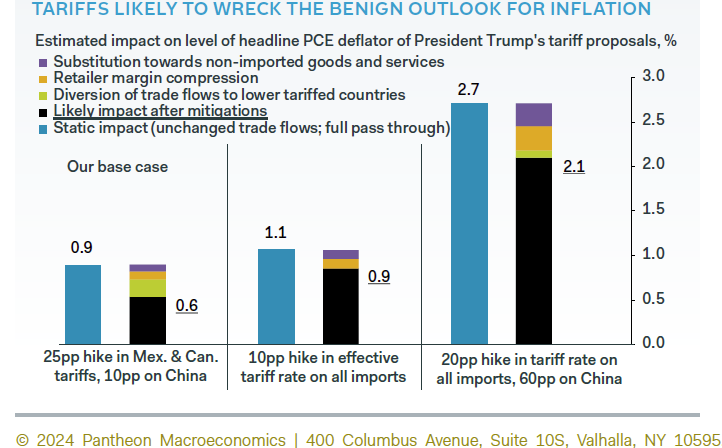

Tariffs could, at their extreme, have a pronounced inflationary impact.

Per the prior graph, a “worst-case” 20% tariff increase on all U.S. imports and

a higher 60% on imports from China could cause a 2.1% addition to U.S. consumer

prices. This would be a one-time bump in

inflation, though spread over many months of implementation. The Fed and

bond market may not overreact to this, but some reaction with higher interest

rates would be expected.

If tariffs are more of a threat and trade bargaining tool and only a 10% tariff on all imports occurs, then the inflation impact is projected to be a less-painful 0.9%. However, the federal budget deficit would be larger, which favors implementing larger tariffs over smaller tariffs.

The prior graph does not include the effect of foreign currency depreciation. Higher U.S. interest rates and slower foreign economic growth from tariffs are likely to cause the yen, euro, yuan, peso and other currencies to decline versus the dollar. If tariffs rise by 10%, but foreign currencies decline by 10%, then there would be no inflationary impact to U.S. consumers from the tariffs. However, if other countries respond with their own tariffs and trade barriers, this will weaken the dollar somewhat and slow U.S. economic growth. It is impossible to know all the consequences of a full-blown trade war with many of our trading partners, but we should expect a modest pick-up in inflation and slowing economic growth, only partly offset by foreign currency depreciation.

Overall, the effects of pending tariffs do not appear to pose a major economic and investment threat, unless a severe tariff outcome occurs.

Employment and Recession Outlook

As of November 2024, the U.S. unemployment rate stood at 4.2%, reflecting a gradual increase from 3.7% in November 2023. However, much of this increase in the unemployment rate was due to a larger available labor pool, due to an increase in the labor participation rate.

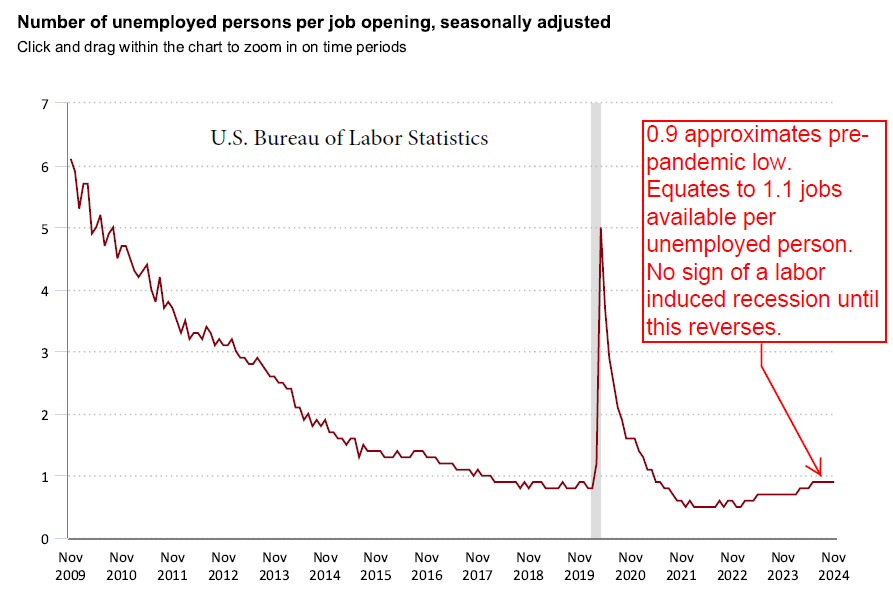

A different way to review the unemployment situation is to look at the number of unemployed persons relative to unfilled jobs available. The next graph shows that there are 0.9 persons unemployed per job available.

This shows a still-tight labor market, but not nearly as tight as in late 2021 when the ratio of unemployed to jobs available was 0.5. Back in 2014 the ratio of unemployed to jobs available was over 2. So even if the current ratio of unemployed to jobs available exceeds 1.0, as it did in 2017 and earlier, this does not mean a recession is imminent. The economy can still grow as unemployment rises modestly. We expect U.S. real GDP to grow in the 2-3% range in 2025.

Post-pandemic efficiency has increased as businesses adapted to labor and material shortages. AI advancements should also boost productivity, though it may take years for this to occur in a meaningful manner. Higher productively means higher wages can be paid without adding to inflation, so these are beneficial trends. In addition, the average household still is in good financial shape when looking at total household debt payments relative to total income.

However, a sizeable and growing minority are struggling with credit card and auto loan payments, resulting in “serious” delinquencies rising by over 8% on these higher-risk borrowings (JP Morgan, NY Fed). It appears that all of the pandemic support payments have been spent, and the cessation of forbearance on various rents, mortgages, and student loans has resulted in adverse financial consequences for those with fragile finances. This may, in turn, negatively affect lenders and businesses catering to these households. On the plus side for inflation, this may account for the recent increase in employment participation rates, which should temper wage growth.

In the Eurozone, the unemployment rate was approximately 6.5% near year-end 2024, indicating a modest improvement from previous years. This improvement has occurred as Europe has largely adjusted to fuel shortages and inflation issues caused by the Ukraine-Russia conflict. Nevertheless, if geopolitical issues increase further, including possible large U.S. tariffs, then economic and labor conditions may be more adversely impacted in Europe, other developed markets, and the emerging markets, when compared to the U.S.

China’s economy has suffered from an overextended real estate market. However, some government stimulus programs have resulted in modest recent economic growth in China. Should larger U.S. tariffs be imposed, China has many more potential stimulus programs they could employ to moderate this impact. Additional currency devaluation could blunt some of the tariffs as well. Given these conditions and risks, it is hard to get enthused about Chinese investments.

Investment Implications for U.S. and non-U.S. Stocks in 2024

The S&P 500 is currently valued at a forward P/E ratio of 21.5x as of December 31, 2024, which is significantly above its 30-year historical average of 16.9x. This valuation places the index approximately 1.4 standard deviations above its historical mean, signaling that the overall market is overvalued.

The S&P 500 can be split into two different components: the largest 10 firms and the other 490 companies. The largest 10 companies, including the mega-cap Magnificent 7 (Meta, Alphabet, Amazon, Apple, Nvidia, Microsoft, Telsa) now make up nearly 39% of the entire S&P 500 index, an all-time high in terms of S&P 500 top-ten concentration.

These largest 10 firms trade at a P/E ratio of nearly 30, which is at a 45% premium to their 28-year average P/E ratio of 20.6 (JP Morgan Guide to the Markets). The other 490 firms trade at a year-end 2024 P/E ratio of 18.2, which is a much smaller 15% premium over its 28-year average. So the “average firm” (the 490 companies), have a reasonable, perhaps slightly elevated, valuation versus the historically large overvaluation of the largest 10 firms.

These largest 10 mega-cap firms have had better earnings growth than the average firm, so they deserve a higher valuation and should have a higher P/E ratio. However, the current valuation suggests a “priced to perfection” condition and, should growth slow from lofty expectations, significant price declines could occur, much as happened in the 2000-2002 dot-com bust period.

Owning nearly 40% in the largest 10 firms presents both a valuation and diversification risk. A 20% or lower exposure to these largest 10 firms would be a more prudent approach. Owning smaller and mid-cap stocks or using a non-cap weighted index (e.g. S&P equal-weighted index) are ways to reduce the concentration in these 10 largest U.S. firms.

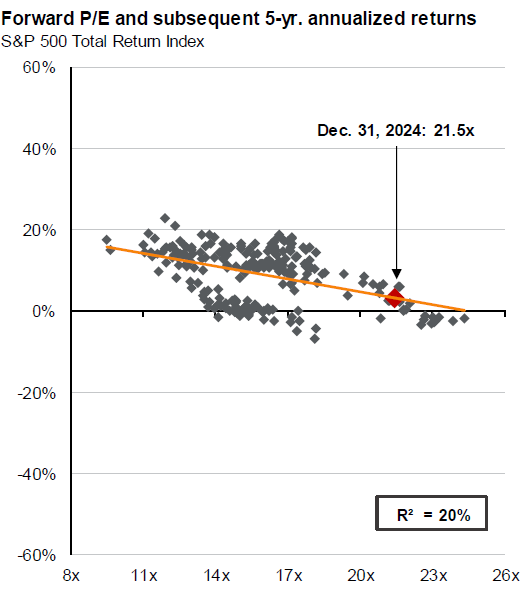

Valuations do matter. When stocks trade at elevated valuations, the returns over the subsequent 5 years tend to be anemic.

Historically, when the S&P 500 has been valued close to 21.5 times earnings, like now, the average annualized return 5 years hence has been close to or under 5% (red square on graph above, JP Morgan Guide to the Markets).

When priced in the 22-23 times earnings range, which we are close to now, 5-year subsequent returns have been flat or negative. In March 2000, when the forward P/E ratio of the S&P 500 exceeded 25, stocks subsequently lost 45%. It took 12 years before the S&P sustainably reached and exceeded its March 2000 highs. That was a long time to not make money.

Foreign stocks

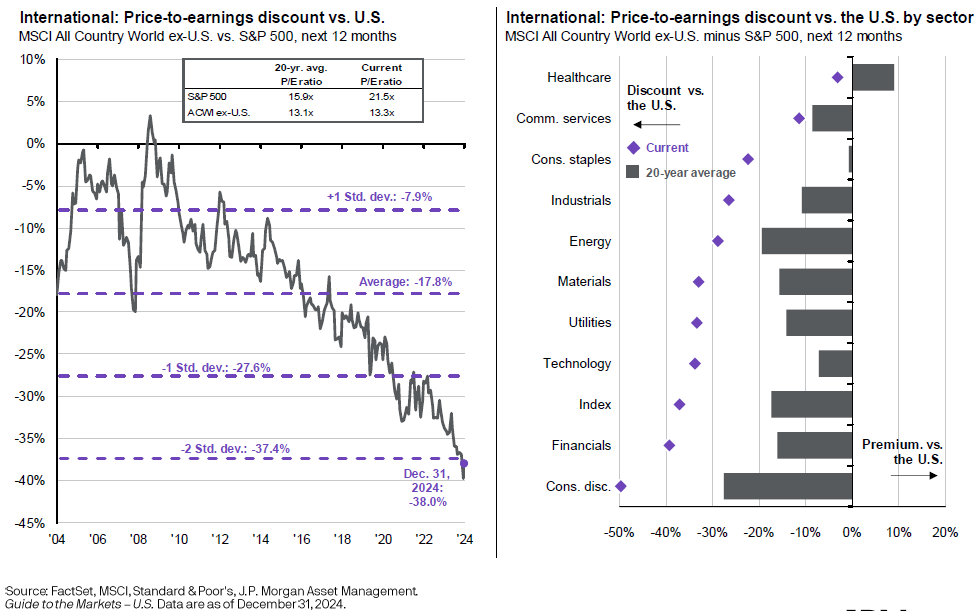

In 2024, most foreign stock markets had positive returns, but lagged U.S. stocks. Corporate profits are improving overseas, but generally at a slower rate when compared to U.S. firms. As a result of lagging price performance, foreign stocks are at the most attractive valuation relative to the U.S., going back to at least 2004.

The upper left graph shows that foreign stocks are trading at a 38% P/E discount to the S&P 500, the largest discount over the last 20 years. The 20-year average foreign stock discount of 17.8% reflects slower earnings growth of foreign stocks, but the current discount being more than double that suggests that foreign stocks offer a good value when compared to U.S. stocks. Even adjusted for sectors, foreign stock sectors are trading at much wider discounts to the U.S. sectors than is typical (diamonds versus gray bars in right portion of above graph).

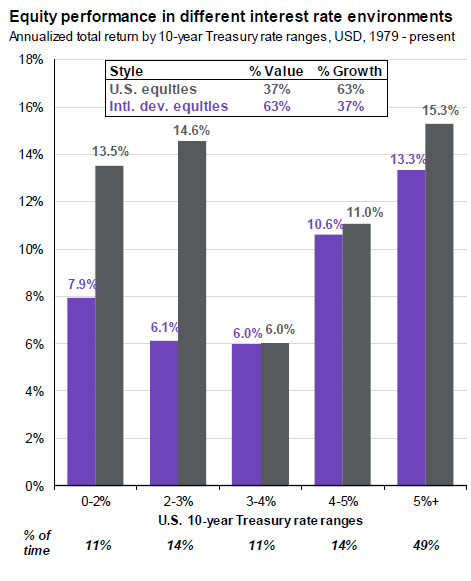

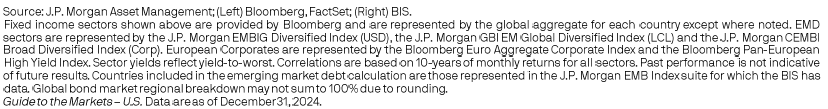

U.S. stocks tend to strongly outperform foreign stocks when U.S. long-term interest rates are below 3%, per the left portion of the adjacent chart. However, once 10-year Treasury yields reach 3%, U.S. and foreign developed country stock markets have similar returns.

Lower-than-3% interest rates tend to be highly stimulative to U.S. economic growth and tend to encourage more risk taking and also tend to expand valuations of growth stocks. When interest rates exceed 3%, the U.S. stimulus is less, and it tends to favor slower growing “value” companies, which comprise the majority of foreign stock markets (e.g. financials, industrials).

Note that a similar relationship to interest rates above 3% exist for U.S. growth stocks and U.S. value stocks. (Additional data and graphs are available upon request.)

The 10-year Treasury has risen recently to approximately 4.6%. Even if this yield declines to about 4% later, this is in the yield terrority that no longer materially favors U.S. stocks over foreign stocks and no longer favors growth stocks over value stocks. As both U.S. value stocks and foreign stock markets show very attractive valuation characteristics in comparison to U.S. growth stocks and the S&P 500 index, we recommend having a significant allocation to both U.S. value stocks and to foreign stocks.

As mentioned earlier, pending tariffs pose both a currency and stock price risk to owning foreign stocks. Much of this risk appears already priced into foreign stocks, hence the wide current valuation discount. Depending upon how various countries respond to U.S. tariffs, foreign currency risk remains high. Therefore, if an investor intends to hold significant foreign developed market stocks in a portfolio, we recommend that a portion of these foreign assets be currency hedged. Many ETFs and mutual funds that own foreign developed market stocks employ currency hedging to reduce or eliminate the risk of foreign currency depreciaton.

WESCAP employs some currency-hedged foreign stock funds to account for short-term higher currency risk. If tariffs and reactions to tariffs are not too severe, then we will likely reduce some of the currency hedging as the U.S. dollar appears very expensive to most foreign currencies based upon purchasing power parity differences. When foreign trade expectations settle down, we would expect the U.S. dollar to also find a new equilibrium that is lower than where it is now.

Fixed Income and Other Asset Classes

Fixed Income: Fixed income assets now offer reasonable yields, unlike most of the last 10 years. In order to fight inflation, most central banks have raised interest rates and reversed many stimulus measures. Both short-term and long-term interest rates rose as a response to the high inflation rates of 2022-2023. However, by the fourth quarter of 2024, short-term interest rates started to decline, along with inflation rates. Nevertheless, U.S. longer-term interest rates increased in late 2024 due to U.S. federal budget deficit funding concerns and inflation rate progress stagnation. This resulted in negative 2024 total returns for most fixed income assets other than ultra short-term duration fixed income assets.

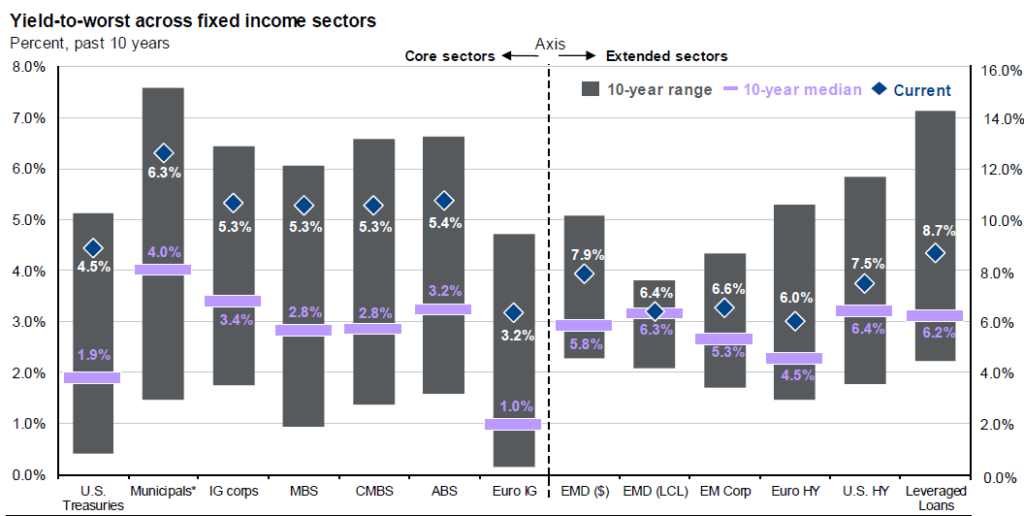

The next table shows various income yields as of year-end 2024. It also shows the 10-year average yield to shortest possible maturity (yield-to-worst).

The U.S. Treasury securities index

had a year-end 2024 yield of 4.5%, considerably higher than the 10-year median yield

of 1.9%. Assuming inflation rates eventally

subside further, we would expect Treasury rates to trend down as well. If U.S. inflation makes its way down to 2.5%

over the next few years, then T-bills yields could be close to 3% and the

10-year Treasury yield could be in the 4% to 4.25% range, which is somewhat

lower than the current rate. If

inflation stabilizes at 3%, then add 0.5% to these future yield

expectations.

However, it is unlikely that the U.S. Federal Reserve will sit still for a 3% long-term inflation rate. They are targeting 2%, but it is possible that they will accept a slightly higher 2.5% inflation rate. If inflation were to persist at a 3% rate, we would expect the Fed to boost interest rates again to slow the economy and bring the inflation rate down to the 2-2.5% range.

Therefore, current high interest rates present an opportunity to receive a reasonable yield, noticeably above future expected inflation, and the possibility of capital gains if long-term rates trend down.

Per the chart above and looking at the year-end yields (blue diamonds on each bar), certain fixed income assets look particularly attractive. U.S. Treasuries in the 5-10 year range are currently attractive. For investors in the top two or three federal tax brackets, tax-exempt municipal bonds also are attractive. Also attractive are corporate investment grade bonds, mortgage and asset-backed securities.

Higher-yielding fixed income assets trade off a higher yield with increased credit risk.. High Yield (junk) bonds offer a 7.5% yield, which is modestly higher than the 10-year median of 6.4%. However, if defaults were to rise above current low levels, then these bonds could underperform. Leveraged loans offer a slightly higher 8.7% yield and have somewhat better outcomes in event of default when compared to high yield bonds. Leveraged loans tend to be floating-rate loans and thus will not benefit if the Fed continues to lower short-term interest rates.

Emerging markets dollar-denominated bonds offer an attractive 7.9% yield, well above their 10-year median yield of 5.8%. Being dollar-denominated, if U.S. yields come down and bond prices rise, then high-quality dollar-denominated emerging markets bonds should follow.

Short-term money markets and T-bills—not shown above—with close to 4% yields and with little or no price risk, remain attractive, though not as attractive as in early 2024 when yields were closer to 5%. Extending maturies makes more sense in 2025 than it did in 2024.

A mix of these fixed income assets is recommended—different types, different maturities, and different quality types. Extending maturities this year and reducing credit risk is also recommended. If a recession develops (not our base case), then credit sensitive fixed income can be added at lower prices (higher yields) than currently.

Real estate: In last year’s Outlook, we presented data that showed that residential real estate was holding up well despite higher mortgage rates. This remained the case in 2024 too, though the rate of home price appreciation has slowed to 3.9% (Case-Shiller). A low supply of new housing and robust demand is supporting home prices and home mortgage solvency. A recent rise in mortgage rates is likely to dampen demand. Affordability relative to household income is now worse than before the 2008 financial crisis. Therefore, increases in home prices may slow further in 2025 and perhaps decline under adverse conditions.

A year ago, we presented data showing impending distress to commercial real

estate (retail, office apartment, hotels and other types). In 2024, this deteriorating outlook became

reality for many property types.

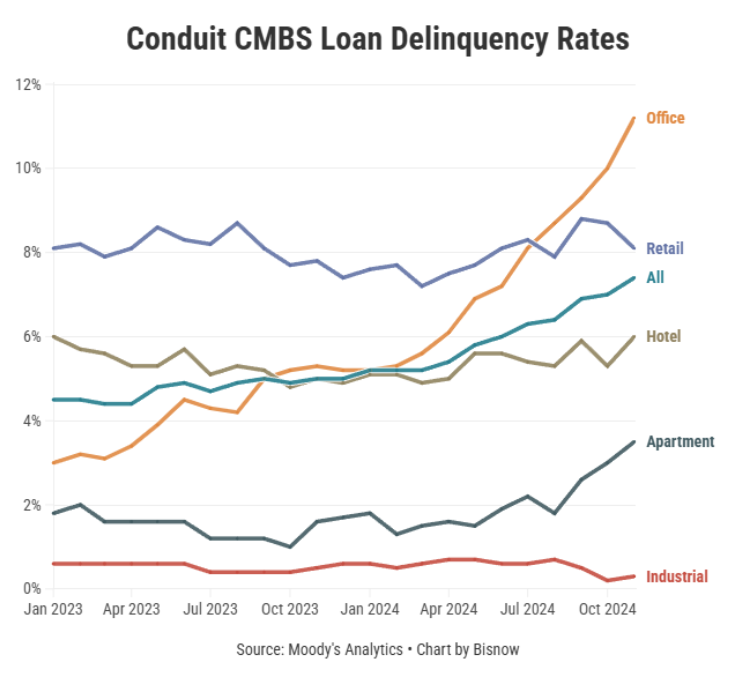

Commercial Mortgage Backed Securities (CMBS) showed significant

increases in 60-day delinquincy rates.

Office space CMBS delinquencies have climbed to over 11%. Retail stayed steady at a high 8% rate. Apartments had delinquency rates under 2% for

some time, but now are approaching 4%. Newly

built apartments are resulting in lower rents in many areas. Higher insurance and operating costs and

higher interest rates are affecting apartment cash flows. As the mortage market for apartments is many

times larger than for office space, this suggests trouble for banks and other

lenders to both office and apartment buildings.

Industrial properties, including data centers, are showing very little

distress due to high demand.

Many lenders have been extending maturing loans rather than accepting defaults. About half of maturing office loans were extended in 2024. As long as they make the mortgage payment, they are not considered delinquent. Banks have been lending to private non-bank lenders, which in turn make real estate loans. This removes the loan from being a bank-issued risky real estate loan and shifts some of the risk to the private lender. Most private lenders have adequate capital to survive mortgage defaults. They also charge more interest, often more than 12%, so they can afford to take some calculated risks.

While a pretend-and-extend strategy

can help avoid a near-term meltdown in mortgage loan and property prices, it

also tends to prolong the difficulty. As lenders begin to foreclose more on

properties in 2025 and 2026, and prices decline further in distressed real

estate sectors, there may be some attractive real estate opportunities. However, selectivity will be important.

Hedged and Alternative Assets and Strategies: Some assets are thought to be good inflation hedges. These include tangible assets like gold and other commodities. This might be true for very long periods of time (decades) or for countries that experience hyperinflation (1920s Germany), but the correlation of these assets to a normal range of inflation (2-7%/year) is low in the short run. These may provide some inflation protection in some periods and fail in others. While gold, oil, and other commodity short-term inflation hedging is questionable, they nevertheless tend to have lower correlations to stocks and bonds and can provide decent diversification benefits to a portfolio. Commodities and precious metals have typically underperformed stocks in the long run, as they have no earnings and pay no interest, and growth in demand for these physical assets tends to be less than overall global economic growth. Some consider crypto assets to have similarities to gold, but with much higher gain and loss potential.

Owning assets or employing strategies that are not highly correlated to stocks, bonds, inflation, or interest rates can have an important role in portfolios. Various hedge fund strategies attempt to hedge out traditional stock or bond market risks. Such strategies often use a long-short approach, going long for the more attractive asset and going short for the less attractive asset. Profits are made when the long asset outperforms the short asset, and the hedge (being both long and short) tends to keep volatility low. Examples of this include merger arbitrage, convertible bond arbitrage, and long-short allocations to various types of stock and fixed-income assets. There are many hedge funds that have the flexibility and expertise to follow these strategies. For those who do not qualify for or want to avoid hedge funds, there are a small number of accessible mutual funds that have been successful as well.

Alternative illiquid investment strategies provide another option. This category often includes owning private market investments (e.g., private equity, private debt, art, farmland). Private market investments can have higher returns than public stock and bond markets due to the return premium demanded to hold illiquid assets. There are a number of hedge funds and private investment vehicles that focus on these types of assets. Additionally, there are some publicly-registered closed-end and interval mutual funds that offer ownership in some of these non-liquid assets.

Hedge fund, illiquid, and alternative strategies can be very diverse, as can the mutual funds and ETFs following similar strategies. Considerable expertise is required for understanding the pros and cons of various approaches. We intend to hold a number of these in various portfolios and we are available to discuss these investments in more detail.

Conclusion

Volatility is expected to remain high for stocks, with some stock sectors and countries experiencing positive returns in 2025, with others struggling. The 5-year outlook for U.S. growth stocks and the S&P 500 is muted due to high valuations. Value stocks, small stocks, and foreign stocks offer the best prospects of above-average returns over a 3-5 year period. Long-term higher-quality bonds have become more attractive, while lower quality high-yield bonds and bank loans may be facing some headwinds. Short-term and variable-rate high-quality fixed-income investments are currently attractive due to high yields and low risk, although they become less attractive if the Fed cuts interest rates further. Alternative and hedge fund-like assets may provide reasonable returns and offer diversification from traditional stocks and bonds.

WESCAP will continue its efforts to add value by following a disciplined asset allocation approach tailored to appropriate risks with frequent rebalancing, while taking advantage of market and valuation trading opportunities. For more details, please contact your WESCAP Group advisor.