How to “Freeze” Your Credit

What is a security freeze (also called a “credit freeze” or just “freeze”) of your information at a credit bureau? A security freeze requires that the bureau does not divulge your credit information to any one other than those required by law. In effect, if you freeze your data at each of the credit bureaus, new credit (e.g. loans and credit cards) are highly unlikely to be established in your name because potential lenders cannot determine your credit quality when the bureaus will not release your information. (more…)

Read MoreIntroduction to 529 Plans

State-administered College Savings Plans (often called 529 plans) are attractive vehicles for accumulating savings to pay for post-secondary educational expenses. Any individual donor, regardless of income level, can fund an account for any individual beneficiary – while still retaining control over the account. By funding a plan, the donor’s contribution is (in most cases) removed from his/her own estate. The plan’s beneficiary can be changed to any of a wide array of relatives (of the beneficiary) as often as needed. (more…)

Read MoreWESCAP’s Andy Edstrom Published in The Wall Street Journal

WESCAP Group is pleased to announce Andy Edstrom’s publication in the Wall Street Journal (Letters to the Editor, September 13, 2017 issue). Coming on the heels of his publication in The Economist last year (WESCAP’s Andy Edstrom Published in The Economist), it is another example of WESCAP professionals influencing the global conversation about important financial issues. (more…)

Read MoreWhat You Need to Know About the Equifax Security Breach

Equifax, one of three nationwide credit-reporting agencies, recently revealed to the public that it has had one of the largest cyber security breaches in history. The number of people affected by this breach is estimated to be roughly 143 million in the United States alone, as well as individuals in the UK and Canada. (more…)

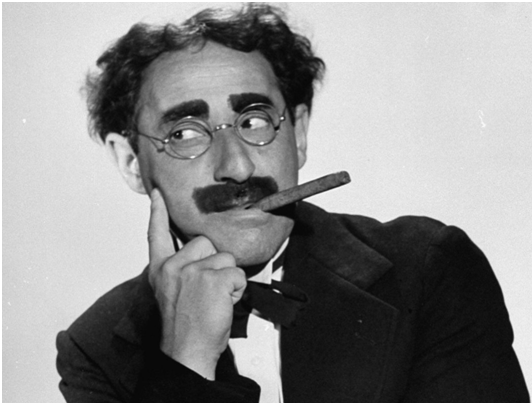

Read MoreHot IPOs and the Wisdom of Groucho Marx

The ongoing mania for “unicorns” (private companies valued at over $1 billion) has is developing into a wave of very-high-profile Initial Public Offerings (“IPOs”). (more…)

Read More