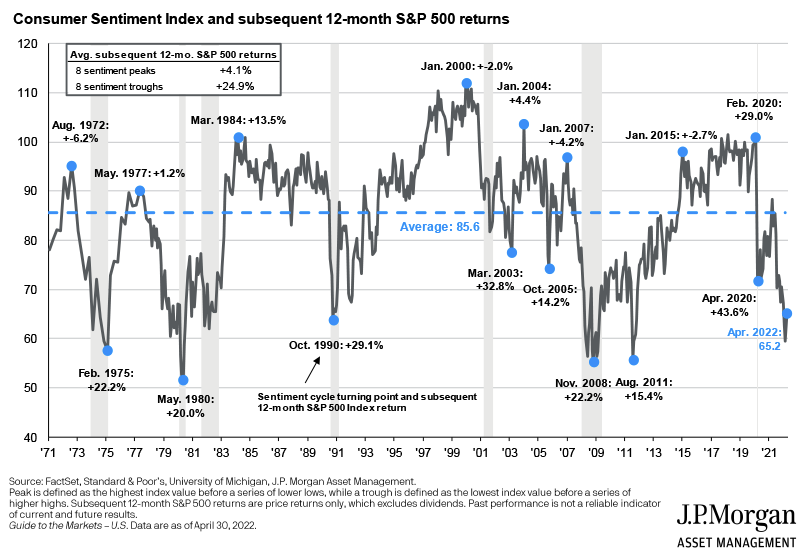

Stock Market Update May 2022: Contrarian Indicators Suggest Strong Stock Market Returns 12 Months Hence

U.S. Consumer sentiment is so poor now (April 2022) that future stock market returns are expected to be higher than average. As can be seen in the chart below, when the University of Michigan Consumer Sentiment (confidence) Index has reached eight troughs in the last 51 years, the subsequent 12-month return of the S&P 500 stock index has averaged 24.9%.

In April 2022, the Consumer Sentiment Index reached a low only exceeded four other times. Such pessimism occurs during periods of extreme financial and economic distress. Within 12 months, conditions are expected to improve enough that pessimism wanes and stocks rally as a result.

(more…)Read MoreQuarterly Commentary Q1 2022: Inflation, Interest, and Stocks

This report includes current and past portfolio returns and current positions as of March 31, 2022.

During the first quarter of 2022, the Russia-Ukraine conflict spurred additional supply chain, energy and strategic metals supply disruptions, further accentuating inflationary pressures.

(more…)Read MoreCybersecurity Threats and Best Practices

Cybercrime and fraud are serious threats that can compromise your identity, personal property, and assets. This criminal activity committed by hackers targets your computer, computer network or networked device in pursuit of digital information and fraudulent profits.

(more…)Read MoreUkraine Invasion and Financial Markets

Global markets appear to be responding in line to the risks associated with the Ukraine-Russia conflict. This assumes no recession, no widespread cyber warfare, no direct military conflict among great powers, and no major financial markets contagion. While unlikely, if any of these do occur, global stock markets and credit-sensitive fixed-income could decline noticeably from current levels.

(more…)Read MoreEconomic and Investment Outlook for 2022

This year we once again focus on the main questions investors are asking coming into 2022: Will the coronavirus be vanquished? What does this mean for people, businesses and investors? Secondarily, is inflation really transitory or longer-term? Are stock and bond markets overvalued?